To realize our basic management policy of obtaining the understanding and consent of our shareholders by continuously improving corporate value over time and creating innovative services, the Credit Saison Group is implementing a variety of initiatives to improve and strengthen our corporate governance in recognition of the enormous importance of bolstering management supervisory functions to attain business objectives and enhance management transparency.

Related SDGs

- Business management system

- Dialogue with shareholders and investors

- Principles Regarding Antisocial Forces

Corporate Governance

Our Basic View on Corporate Governance

To realize our basic management policy of obtaining the understanding and approval of our stakeholders such as our customers, business partners, employees, shareholders and society by continuously improving corporate value over time and creating innovative services, the Company is implementing a variety of initiatives to improve and strengthen our corporate governance in recognition of the enormous importance of enhancing management transparency and bolstering management supervisory functions to attain business objectives.

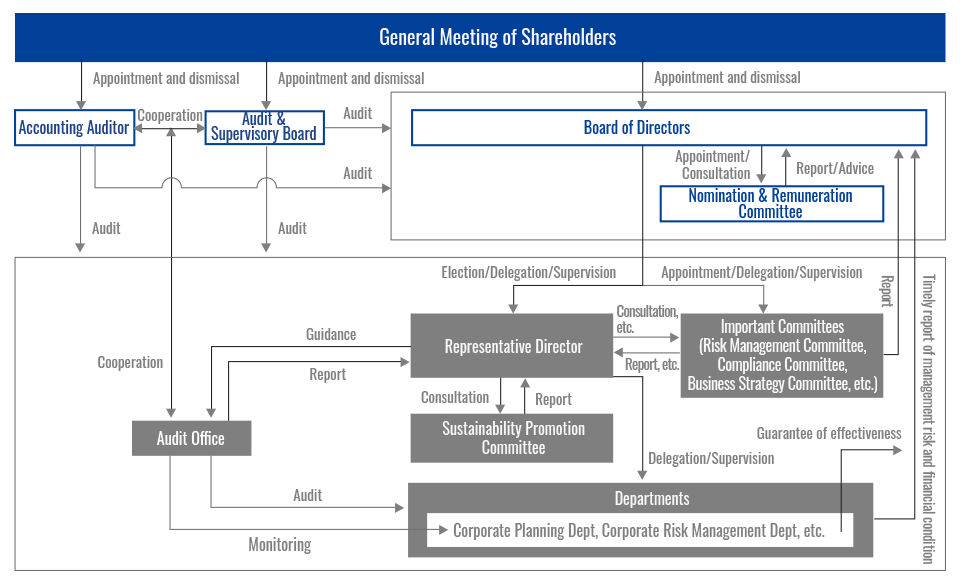

Corporate Governance Structure

Basis for Corporate Governance System Selection

Credit Saison (the Company) has adopted the Audit & Supervisory Board (the “ASB”) model, with the ASB members. The Company has established the Board of Directors, the ASB, and the accounting auditor as the corporate’s organization. To ensure we retain the confidence of our shareholders and other investors, we strive to improve and strengthen corporate governance by nominating outside directors and the outside ASB members. The Board of Directors and Nomination & Remuneration Committee receive advice and recommendations from outside directors to ensure the appropriateness of business decision-making. This enables directors, who are well versed in business matters, to maintain and improve management efficiency. In addition, the ASB is strengthening its management oversight function by coordinating with directors, executive officers and others from the Internal Audit Office and the unit responsible for supervision of internal controls and the Audit Department ensures its independence by having a direct reporting line to the Board of Directors, separate from reports to the Representative Director.

In March 2020, we reviewed the composition of the Board of Directors and introduced our executive officer system in order to further strengthen our corporate governance system through the separation of business execution and management oversight. Thus, we achieved more appropriate management and supervisory functions and establish an efficient business execution system.

1. Board of Directors

The Board of Directors consists of 12 Directors, including 4 independent outside Directors. Along with deciding operational execution with regards to important matters concerning management, the Board oversees the performance of duties by Directors. The Board discusses various proposals, monitors the status of business execution, and engages in active exchanges of opinions, including with outside directors, in order to ensure the effectiveness of decision-making and oversight. Outside directors provide useful advice and guidance on our management from objective and neutral perspectives.

2. Audit & Supervisory Board

The ASB consists of 3 ASB members, including 2 independent outside ASB members. It determines audit policy and matters concerning the execution of other duties by ASB members as well as compiling audit reports.

3. Nomination & Remuneration Committee

As an advisory body to the Board of Directors, the Nomination & Remuneration Committee is composed of Directors elected by the resolution of the Board of Directors. It is chaired by the representative Director, chairman CEO, and composed of 5 members, of which majority are independent outside Directors.

The Committee consults with the Board of Directors about matters related to the appointment and dismissal of directors and the formulation of remuneration policies for directors, deliberates them and submits reports about such matters to the Board of Directors.

The members of our corporate governance body are as follows.(◎ Chairperson)

| Member | Board of Directors | ASB | Nomination & Remuneration Committee |

|---|---|---|---|

| Representative, Chairman and CEO Hiroshi Rinno |

● | ◎ | |

| Representative, Executive President and COO Katsumi Mizuno |

◎ | ● | |

| Representative, Executive Vice President and CHO Naoki Takahashi |

● | ||

| Director, Senior Managing Executive Officer and CDO, CTO Kazutoshi Ono |

● | ||

| Director, Senior Managing Executive Officer Kosuke Mori |

● | ||

| Director, Managing Executive Officer Naoki Nakayama |

● | ||

| Director, Managing Executive Officer Shunji Ashikaga |

● | ||

| Director Kosuke Kato |

● | ||

| Outside Director Hitoshi Yokokura |

● | ● | |

| Outside Director Eiji Sakaguchi |

● | ||

| Outside Director Yumiko Hoshiba |

● | ● | |

| Outside Director Kozo Makiyama |

● | ● | |

| Standing Audit & Supervisory Board Members (Full-time) Hideo Suzuki |

◎ | ||

| Standing Audit & Supervisory Board Members (Full-time) Hiroaki Igawa |

● | ||

| Audit & Supervisory Board Members Chie Kasahara |

● |

Skills Matrix for Directors and Audit & Supervisory Board Members

| Name | Corporate management | Global | Finance and accounting | Personnel / Labor affairs |

Legal affairs / Risk management |

|---|---|---|---|---|---|

| Directors | |||||

| Hiroshi Rinno | ● | ● | ● | ||

| Katsumi Mizuno | ● | ● | |||

| Naoki Takahashi | ● | ● | ● | ||

| Kazutoshi Ono | ● | ● | |||

| Kosuke Mori | ● | ● | ● | ||

| Naoki Nakayama | ● | ● | |||

| Shunji Ashikaga | ● | ||||

| Kosuke Kato | ● | ● | ● | ||

| Hitoshi Yokokura OutsideIndependent |

● | ● | ● | ||

| Eiji Sakaguchi OutsideIndependent |

● | ● | ● | ||

| Yumiko Hoshiba OutsideIndependent |

● | ● | |||

| Kozo Makiyama OutsideIndependent |

● | ● | |||

| Audit & Supervisory Board Members | |||||

| Hideo Suzuki | ● | ||||

| Hiroaki Igawa OutsideIndependent |

● | ● | |||

| Chie Kasahara OutsideIndependent |

● | ● | |||

| Name | Sales / Marketing |

Digital / IT |

M&A / New business |

Real estate | Finance / Loans |

ESG |

|---|---|---|---|---|---|---|

| Directors | ||||||

| Hiroshi Rinno | ● | ● | ● | ● | ||

| Katsumi Mizuno | ● | ● | ● | ● | ● | |

| Naoki Takahashi | ● | ● | ● | ● | ||

| Kazutoshi Ono | ● | ● | ||||

| Kosuke Mori | ● | ● | ● | |||

| Naoki Nakayama | ● | ● | ● | |||

| Shunji Ashikaga | ● | ● | ● | |||

| Kosuke Kato | ● | ● | ● | ● | ||

| Hitoshi Yokokura OutsideIndependent |

||||||

| Eiji Sakaguchi OutsideIndependent |

● | ● | ● | ● | ||

| Yumiko Hoshiba OutsideIndependent |

● | ● | ||||

| Kozo Makiyama OutsideIndependent |

● | ● | ● | |||

| Audit & Supervisory Board Members | ||||||

| Hideo Suzuki | ● | |||||

| Hiroaki Igawa OutsideIndependent |

● | ● | ● | |||

| Chie Kasahara OutsideIndependent |

● | ● | ● | |||

Policy on Strategic Shareholdings and Criteria for Exercising Voting Rights

1. Details of policy and verification related to Strategic Shareholding Shares

The Company holds strategic shareholding shares only when they are necessary and reasonable for our Company Group’s business strategies.

To examine the reasonableness of holdings, the Company comprehensively verifies the profitability of holdings at the meetings of the Board of Directors and ALM committees based on an appropriate understanding of the risks and costs associated with holding them as well as the returns from holding them, taking into consideration a mid-term or long term perspective.

As a result of the verification, the Company promptly sells the shares which are decided to be unreasonable to hold, taking into account its market influences and other factors.

2. Criteria for Exercising Voting Rights Pertaining to Strategic Holding Shares

The Company comprehensively determines whether exercising the voting rights of the shares it holds conforms to the purpose of the Company's shareholdings and contributes to the common interests of the shareholders of the investees, and appropriately exercises such rights.

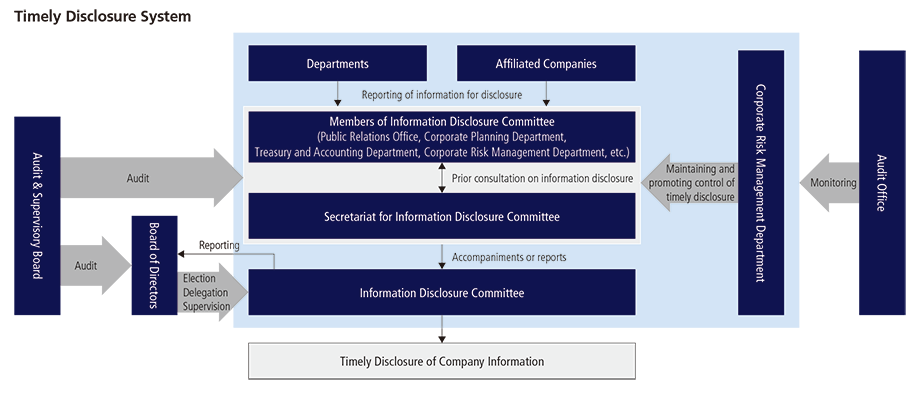

Timely Disclosure System

The status of internal systems related to the timely disclosure of Company information is described below.

1. Basic approach to timely disclosure of Company information

As a publicly listed entity, the Company is obligated to disclose corporate information in a timely and appropriate manner in accordance with laws and regulations related to financial products and securities listing regulations prescribed by the Tokyo Stock Exchange, Inc. We also believe that timely and appropriate disclosure of corporate information forms the basis of a sound financial product market.

In order to fulfill these obligations, the Company has established “Information Disclosure Rules” and intends to disclose corporate information promptly, accurately, and fairly from the perspective of investors.

2. Internal systems for timely disclosure of Company information

To ensure the completeness, appropriateness, and timeliness of information collection and disclosure, we set up an Information Disclosure Committee, which collects information on the Company and its affiliates (hereinafter, “Group Companies”), determines the necessity of information disclosure, and discusses variousrelevant documents based on the aforementioned Information Disclosure Rules.

The Information Disclosure Committee is chaired by the President or a person appointed by the President and consists of officers and employees from the Group Strategic Management Department, Corporate Planning Department, Treasury and Accounting Department, Corporate Risk Management Department, and the like. In addition, the Corporate Planning Department and the Treasury and Accounting Department have jointly established an Information Disclosure Committee Secretariat, into which Company information collected by each Committee member is channeled.

In principle, disclosure of information on Group Companies collected by Committee members is first discussed with the Information Disclosure Committee Secretariat, which decides whether or not to make proposals or reports to the Committee.

The Information Disclosure Committee discusses whether or not to make timely disclosures of information submitted to it, and also discusses materials to be disclosed and makes resolutions on disclosure, following which disclosure is made promptly according to established protocols.

Information that requires urgent disclosure is first deliberated and resolved at a meeting of the Emergency Information Disclosure Committee, held at the discretion of the chairman of the Information Disclosure Committee, then disclosed.

The Corporate Risk Management Department maintains and promotes disclosure controls, which are monitored by the Audit Department.

Corporate Governance Report

To realize our basic management policy of obtaining the understanding and approval of our stakeholders such as our customers, business partners, employees, shareholders and society by continuously improving corporate value over time and creating innovative services, the Company is implementing a variety of initiatives to improve and strengthen our corporate governance in recognition of the enormous importance of enhancing management transparency and bolstering management supervisory functions to attain business objectives.

Internal Control

Status of Internal Control Systems

1. Systems to Ensure Directors Perform Duties in Accordance with Laws and Articles(Companies Act, Article 362, paragraph (4), item (vi))

To ensure operational execution at the Company as a whole is proper and sound, the Board of Directors shall work to establish compliance systems that ensure overall adherence to relevant laws, regulations and the Company’s articles of incorporation (heretofore, articles) by our corporate Group and build effective internal control systems from the standpoint of further strengthening corporate governance. The ASB shall monitor the functioning and effectiveness of these internal control systems in an effort to identify problems early and improve our precision in addressing them.

2. Systems for Managing and Storing Information on Performance of Duties by Directors(Regulation for Enforcement of the Companies Act, Article 100, paragraph (1), item (i))

- (1)Information on the performance of duties by directors (minutes for Board of Directors meetings, documents circulated to directors to obtain their approval, written approvals, etc.) shall be recorded in writing, etc. and shall be stored and managed based on “information management basic rules” and other internal rules.

- (2)A system enabling prompt responses has been established for cases where directors or ASB members request to view the aforementioned information.

3. Systems for Rules on Loss Risk Management and Other Matters(Regulation for Enforcement of the Companies Act, Article 100, paragraph (1), item (ii))

- (1)Concerning risk management, the Company has stipulated “risk management rules” and “rules concerning loss risk management,” and the Company shall work to restrain risks from materializing and minimize the effects on the Company when risks materialize, centering on the Risk Management Committee and the organization with jurisdiction over risk management. In the event risks requiring responsive measures materialize or concerns that risks will manifest become evident, the aforementioned committee and department shall work to respond quickly and swiftly restore the Company’s functions to working order based on “crisis management rules.”

- (2)To the aforementioned end, the Company shall conduct regular internal education and training for those involved based on our “risk management rules,” “rules concerning loss riskmanagement” and “crisis management rules.” The Board of Directors shall regularly review such initiatives and instruct relevant parties on how to correct or improve them in an effort to maintain and improve risk management systems.

- (3)In preparation for the emergence of emergency situations such as a large-scale natural disaster, the Company shall strive to ensure the safety of our management foundation in emergencies by adopting countermeasures to reduce to the extent possible business continuity risks and business interruption risks for key operations.

4. Systems to Ensure Directors Efficiently Perform Duties(Regulation for Enforcement of the Companies Act, Article 100, paragraph (1), item (iii))

- (1)Meetings of the Board of Directors shall be administered based on the “Board of Director’s rules” so directors can properly discharge their duties.

- (2)Directors and executive officers shall properly manage and supervise based on “rules for demarcation of operations and organizations”, “rules on the authorities of specific job functions”, and “Rules of Business Strategy Committee”, etc. to ensure efficient operational execution at the departments and divisions for which they are responsible or in charge.

- (3)In order to respond more swiftly to changes in the business climate and further enhance corporate governance by creating an environment in which the Board of Directors are able to concentrate exclusively on management and supervisory functions, the Company has introduced an executive officer system and established the Meeting of Executive Officers to deliberate and report on general management issues and resolutions of the Board of Directors in advance.

- (4)The Company establishes “business strategy committee”, which makes resolutions to the extent delegated by the Board of Directors, for the purpose of efficient operations of the Board of Directors and to improve discussions on management strategy and corporate governance.

- (5)The operations and resolution matters of the “business strategy committee” are defined by “Rules of Business Strategy Committee” to ensure the proper execution of duties.

5. Systems to Ensure Employees Perform Duties in Accordance with Laws and Articles(Regulation for Enforcement of the Companies Act, Article 100, paragraph (1), item (iv))

- (1)To ensure execution of duties are in compliance with laws, regulations, our articles and internal rules such our compliance rules, etc., the Company shall promote employee awareness about the compliance system and various rules employees are to observe through periodic internal education, led by the Compliance Committee organization with jurisdiction over compliance.

- (2)The compliance consultation desk accepts reports and calls as a contact channel in cases where potential violation of laws, regulations, our articles and internal company rules, etc. have been discovered. The Compliance Committee shall inform the Board of Directors and the ASB without delay about reports of such incidents to promote early-stage resolution of alleged violations.

- (3)To protect against harm from anti-social forces that threaten social order and safety, the Company specifies in its standards of conduct its resolve to stand for justice and face undaunted anti-social forces and strives to inform all its employees of its stance so they will all comply with its standards of conduct. With the organization with jurisdiction over general affairs at the fore, the Company shall respond with resolve to inappropriate demands from antisocial forces through our membership in Tokubouren (the special violence prevention association for the Tokyo metro area), Boutsui tomin center (Anti-Organized Crime Campaign Center of Tokyo) and our close cooperation with law enforcement, police and other related public institutions.

- (4)The rules and regulations for executive officers and the Meeting of Executive Officers rules, etc. shall be developed to ensure the proper execution of duties by executive officers.

6. Systems to Ensure Operational Appropriateness for the Group from Parent to Subsidiaries(Regulation for Enforcement of the Companies Act, Article 100, paragraph (1), item (v))

- (1)Systems for Reporting to the Parent on Matters Concerning Execution of Duties by Directors at Subsidiaries

Based on the “written agreement on Group management” concluded with subsidiaries and “rules for affiliates” the parent has prescribed, the Company, centering on the organization with jurisdiction over affiliates, shall receive reports without delay on attendance at Board of Directors meetings of subsidiaries and minutes of those meetings and related materials, and other important matters from a management perspective. - (2)Systems on Rules Concerning Loss Risk Management at Subsidiaries and Other Matters

Concerning risk management at subsidiaries, the organization with jurisdiction over affiliates is responsible for maintaining an environment for loss avoidance and optimization involving subsidiaries based on “rules concerning loss risk management” and “risk management rules.” The organization with jurisdiction over risk management shall work closely with subsidiaries to coordinate a risk management posture in an effort to restrain risks from materializing and to minimize the effects on the Company when risks materialize. - (3)Systems to Ensure Directors at Subsidiaries Efficiently Perform Duties

Based on the principle of developing the business of subsidiaries, in order to realize management that gives top priority to contributing to the corporate value of the group, considering the profits and optimization of the entire group based on the group strategy, the Company has prescribed in advance matters for discussion in the “written agreement on Group management” and “rules for affiliates” with regards to important matters relating to management of subsidiaries, and it conducts decision-making when necessary based on “rules on the authorities of specific job functions” and other rules. Also, the organization with jurisdiction over affiliates shall also oversee and share information on the business execution status of subsidiaries in an effort to ensure efficiency in operational execution at subsidiaries. - (4)Systems to Ensure Directors and Employees at Subsidiaries Perform Duties in Accordance with Laws and Articles

The organization with jurisdiction over internal audit shall cooperate with the audit department of subsidiaries and implements audits when necessary while monitoring the appropriateness of operational execution. Established to accept reports and calls in cases where potential violations of laws, regulations, our articles and/or internal company rules have been discovered, the internal Group hotline shall strive as a contact channel to be useful to the swift resolution of reported violations and to ensure operational appropriateness at subsidiaries.

7. Matters on Assistants to ASB Members Requiring Support in Performing Duties(Regulation for Enforcement of the Companies Act, Article 100, paragraph (3), item (i))

- (1)Persons who support ASB members (heretofore, assistants) shall assist them in performing their duties.

- (2)The specific number of persons serving as the aforementioned assistants and the content of their duties shall be determined based on discussions with the ASB.

8. Matters Concerning Independence of Said Assistants from Directors, and Matters on Ensuring Effectiveness of ASB Member Instructions to Said Assistants(Regulation for Enforcement of the Companies Act, Article 100, paragraph (3), items (ii) and (iii))

- (1)Personnel decisions concerning assistants (reassignment, evaluations, etc.) shall require the consent of the ASB.

- (2)The aforementioned assistants shall not be assigned to concurrent roles involving operational execution at the Company beyond the scope of internal audit functions. Also, the authority of ASB members to offer instructions and issue orders to assistants shall not be unfairly restricted by the Company.

9. Systems for Reporting to Parent ASB Members(Regulation for Enforcement of the Companies Act, Article 100, paragraph (3), item (iv))

- a.Systems for Directors and Employees to Report to ASB Members

- (1)Directors, executive officers and employees must promptly report to the ASB material violations of the law, our articles or illegal conduct relating to the performance of their duties as well as when they discover facts that could cause serious harm to the Company.

- (2)Directors, executive officers and employees shall report without delay through the relevant reporting line to the ASB decisions and the occurrence of events, accidents, and/or operational troubles that could materially affect business operations and organizations as well as the results of the audits implemented.

- b.Systems for Subsidiary Directors, ASB Members, Employees, or Persons They Debriefed to Report to Parent ASB Members

- (1)The organization with jurisdiction over affiliates shall report the minutes for meetings of the Board of Directors and related materials and other important matters from a management perspective it receives from subsidiaries to ASB members. Also, directors, executive officers and employees of subsidiaries can when necessary report to the Company’s ASB members.

- (2)Directors, executive officers and employees of subsidiaries can report to the internal Group hotline or the organization with jurisdiction over affiliates material violations of the law, our articles or illegal conduct relating to the performance of duties as well as when they discover facts that could cause serious harm to the Company. The organization with jurisdiction over compliance and/or the organization with jurisdiction over affiliates shall report the information they receive to ASB members while accurately processing it in the Compliance Committee.

10. Systems for Ensuring Whistleblowers Are Not Treated Unfairly for Reporting the Aforementioned Matters(Regulation for Enforcement of the Companies Act, Article 100, paragraph (3), item (v))

The Company prohibits unfair treatment of whistleblowers who report to ASB members on the basis of their reporting such matters, as stated in the previous clause. Our “compliance rules” stipulate that those providing information to the aforementioned contact channel will not be disadvantaged in any way, and we strive to promote awareness about this protection among our employees through “our compliance” messages.

11. Matters on Policy for Processing Liabilities and Expenses Arising from Operational Execution by ASB Members, and Systems for Ensuring Effective Audits by Parent ASB Members(Regulation for Enforcement of the Companies Act, Article 100, paragraph (3), items (vi) and (vii))

- (1)ASB members shall attend important meetings so they may ascertain important decision-making processes and the status of operational execution, and they can request investigations and briefings, as necessary.

- (2)The ASB exchanges opinions with the president and representative director as necessary, and shall meet regularly with the public company accounting (PCA) auditor to exchange opinions.

- (3)To ensure an ongoing exchange of information with the ASB, the organization with jurisdiction over corporate planning, the organization with jurisdiction over risk management and the organization with jurisdiction over internal audit shall cooperate closely with each other.

- (4)Regarding cases where ASB members request pre-payment of expenses for performance of duties, such expenses shall be processed swiftly after deliberation and assessment on their validity, primarily by the organization with jurisdiction over corporate planning, which is the budget management division.

Status of Audits

Audits by ASB Members

The Company has an Audit & Supervisory Board (ASB) with four members (including 3 independent outside ASB members).

The Audit & Supervisory Board operates from the perspective of seeing whether the ways directors go about their duties are legal and proper throughout all company operations. It has stipulated audit policies and practices a wide range of audits accordingly, with the emphasis on elements such as stronger Group management and thorough comprehensive risk management.

Internal Audits

The Internal Audit Department, which performs an internal audit function, implements audits of internal controls, risk management, compliance etc. at the Company, including Group companies, and provides assessments and recommendations.

Regarding cooperation with public company accounting auditors, ASB members strive to strengthen cooperation through suitable exchanges of opinions such as receiving reports from PCA auditors on their audit results and audit policy.

Regarding cooperation with the Internal Audit Department, whenever the Internal Audit Department carries out an internal audit, ASB members are briefed on its audit policy and results. ASB members also direct investigations, providing instructions to the Internal Audit Department, which also when necessary serves as the secretariat for ASB members.

Regarding the maintenance of internal control systems, ASB members work to increase the effectiveness of audits, requesting briefings whenever necessary from the Corporate Planning Department, the unit responsible for supervision of internal controls.

The Internal Audit Department briefs the public company accounting auditor on its audit results, internal audit policies and other such matters in an effort to cooperate with the PCA auditor at all times.

Regarding the maintenance and operation of internal controls involving financial reporting, based on internal audit results, the Corporate Risk Management Department strives to cooperate with the PCA auditor by briefing it on related matters and conducting investigations and exchanging opinions as necessary.

Business management system

Personal Relationships between Outside Directors, Outside Audit Board Members and the Company

The Company has four outside directors and two outside ASB members.

To ensure the appropriateness of management decision-making, our directors receive advice and recommendations from the four independent outside directors* who do not have any conflict of interest with general shareholders. This enables our directors, who are well versed in business matters, to maintain and improve management efficiency. We have also appointed two outside ASB members*, who are independent officers, to strengthen the management oversight function.

* Six outside directors and outside ASB members who meet the criteria for being an independent officer are designated as an “independent director” or an “independent ASB member.”

Material Relationship Disclosures of Outside Directors and Outside ASB Members

Please check the Corporate Governance Report.

Corporate Governance ReportReasons for Appointment of Outside Officers and Attendance Records

| Name | Reasons for Appointment | Attendance Records (FY2024) |

|---|---|---|

| Directors | ||

| Hitoshi Yokokura Independent |

As a certified public accountant and an attorney, he has a high level of specialized knowledge and extensive experience in financial, accounting and legal affairs. The Company believes that he can provide useful advice and guidance on its management from his objective and neutral stance based on his expertise and business experience, and has selected him as an Outside Director and designated him as an independent officer. | Board of Directors: 20 / 20 meetings attended |

| Eiji Sakaguchi Independent |

Through his work experience as Representative Director, Chairman & CEO, CBRE K. K. and as a general manager in charge of investment bank services for the real estate sector at an foreign-origin financial institution, he has extensive experience in and broad insight into the real estate business. The Company believes that he will be able to utilize this insight, to provide useful advice and guidance not only on his expertise, but also on its management strategy and global business from his objective and neutral stance, and has selected him as an Outside Director and designated him as an independent officer. | Board of Directors: 18 / 20 meetings attended |

| Yumiko Hoshiba Independent |

She has been involved in the establishment of a publishing company and has 35 years of management experience as its Director and President, developing it into an industry-leading publishing company through direct transactions with bookstores. The Company expects her to provide supervision, advice, etc. from a professional perspective mainly with respect to management and branding, through her accumulated experience in branding of the publishing company as a publisher of business books, etc., that are also popular with women, and her active efforts in the global expansion of Japan’s publishing industry. Based on her expertise and business activities, the Company believes that she can provide useful advice and guidance on its management from her objective and neutral stance, and has selected her as an Outside Director and designated her as an independent officer. | Board of Directors: 15 / 15 meetings attended *As she was newly appointed as a Director at the 74th Annual General Meeting of Shareholders held on June 19, 2024, the number of meetings of the Board of Directors held differs from that of other Directors. |

| Kozo Makiyama Independent |

As President and Representative Director of PARCO CO., LTD., he has extensive experience in and broad insight into PARCO CO., LTD.'s business management and store operations. The Company expects that he will utilize this insight to provide supervision, advice, etc., mainly on management strategy and business management from a professional perspective. Based on his expertise and business experience, the Company believes that he will provide useful advice and guidance on the Company's management from an objective and neutral stance, and therefore has selected him as an Outside Director of the Company. | ー *He was newly appointed as a Director at the 75th Annual General Meeting of Shareholders held on June 25, 2025. |

| Audit & Supervisory Board Members | ||

| Hiroaki Igawa Independent |

He had served in Ministry of Finance and the National Tax Agency for many years and experienced Director General in Finance Bureau and Customs. He has extensive experience in and broad insight into finance and accounting. The Company believes that he is an appropriate person to execute audit services for the Company in an objective and neutral manner, and has selected him as an Outside Audit & Supervisory Board member and designated him as an independent officer (Audit & Supervisory Board member). | Board of Directors: 20 / 20 meetings attended Audit & Supervisory Board: 12 / 12 meetings attended |

| Chie Kasahara Independent |

She has extensive experience and broad insight by virtue of her long experience as a lawyer, and has play an important role in auditing legality of duty execution of Directors of the Company and corporate governance. The Company believes that she is an appropriate person to execute audit services for the Company in an objective and neutral manner, and has selected her as an Outside Audit & Supervisory Board member and designated her as an independent officer (Audit & Supervisory Board member). | Board of Directors: 19 / 20 meetings attended Audit & Supervisory Board: 12 / 12 meetings attended |

Initiatives to Enhance Corporate Governance

In order to keep improving our corporate value, we identify the enhancement of corporate governance as a key management initiative. To this end, we are improving our internal control systems, strengthening our risk management framework, and fully adhering to compliance requirements.

In establishing internal control systems, the Board of Directors decides on basic policies for such, with the aim of building systems that ensure appropriate and efficient operations mainly in the Corporate Planning Department, the unit responsible for overseeing internal controls. As for internal controls on financial reports, the Corporate Risk Management Department leads the way in promoting proper functioning of internal controls in the Company and at our consolidated Group companies and the Internal Audit Department carries out independent monitoring.

With regard to risk management, the Company strives to prevent eliciting risks and to minimize their impact on the Company with Risk Management Committee and the Risk Control Department, which serve as a hub for such striving, and the Audit Department is working to strengthen the system by periodically verifying the monitoring status of each department by the Risk Control Department from an independent standpoint. To be prepared for such occasions, the Company is making efforts to maintain its risk-management system by regularly training its employees, based on the principles of the “Risk Management Regulations,” “Regulations Regarding Management of Risk of Loss” and the “Crisis Management Regulations,” , and the Risk Control Department and the Audit Department hold monthly information coordination meetings to strengthen the cooperation in the second and third lines of defense. In addition to the above, with regard to matters inherent in our Company Group or control matters that involve serious risks, for domestic subsidiaries, the Group Strategic Management Department establishes and controls the matters, and for the overseas subsidiaries, the Global Management Department which is responsible for overall management of overseas affiliate subsidiaries gathers information and coordinates with and reports to the relevant departments within the Company, including the Group Strategic Management Department. By the above, the Company oversees the status of business execution at each Group company and shares information with the departments in charge of each Group company.

The Company has established the Compliance Committee to ensure a legal compliance, fairness and ethical behavior in its corporate activities. In addition to appointing a compliance officer in each department, the Company has established the “Action Declaration” to determine how the company itself should act, and have compiled the “Behavioral Standards” to explain how executives and employees should act. The Company is working to strengthen our compliance system by disclosure on internal website to ensure thorough implementation of this Declaration, disseminating information regarding counseling desk, and conducting compliance training, etc.

With regard to the audit system, in order to meet the demands of the times and the expectations of society, the Company is performing audit functions with the mission “to strengthen global governance of group based on our culture and business, and to fulfill our professional roles and functions so that we can be trusted by shareholders, management, and departments and add value to the organization”. In addition, in order to achieve our mission, we believe it is necessary to “improve audit maturity on a group and global basis” and are working to strengthen our human resources and improve audit quality., etc.

We will continue to study approaches to management that best suit the Credit Saison Group in light of global trends in corporate governance and our basic policies for ensuring the proper functioning of internal controls.

Matters Concerning Composition of Governing Bodies and Organization Management

| Governance system | Company with a statutory Audit &apm; Supervisory Board |

|---|---|

| Number of directors stipulated by the Articles | 25 |

| Term of office for directors stipulated by the Articles | 1 year |

| Chairman of the Board of Directors | President |

| Number of directors | 12 |

| Outside directors on Board | Appointed |

| Number of outside directors | 4 |

| Of outside directors, the number who are “independent directors” | 4 |

| Is there an Audit & Supervisory Board? | Yes |

| The number of Audit & Supervisory Board members stipulated by the Articles | 5 |

| The number of Audit & Supervisory Board members | 3 |

| Appointment status of outside Audit & Supervisory Board members | Appointed |

| Number of outside Audit & Supervisory Board members | 2 |

| Of outside Audit & Supervisory Board members, the number who are “independent directors” | 2 |

Dialogue with shareholders and investors

We are aware of the importance of increasing constructive dialogues with shareholders and investors in order to attain continuous corporate growth and to improve corporate value over the medium and long terms. We have thus drawn up a policy of increasing the number of dialogues.

General Meeting of Shareholders

The Company sends a notice of convocation to shareholders prior to the mandatory deadline (sent not less than 3 weeks prior to the date of the general meeting of shareholders) in order to ensure that shareholders have enough time to consider the agenda. In addition, measures for electronic provision on our website and TDnet begin prior to the mandatory deadline (four weeks prior to the date of the general meeting of shareholders or the date of sending a notice of convocation, whichever is earlier).

Principles Regarding Antisocial Forces

- 1. The Company will not have any relationship with antisocial forces.

- 2. The Company will cooperate with external expert organizations and persons, including police, the Tokubouren (the special violence prevention association for the Tokyo metro area) and lawyers, and will deal with antisocial forces in an appropriate and systematic manner in order to prevent damage that may be inflicted by such forces.

- 3. The Company will not accept any unreasonable demand from antisocial forces, and will firmly deal with such forces and take legal actions.

- 4. The Company will not provide funds to or do back-door deals with antisocial forces.

- 5. The Company will ensure the safety of officers and employees who deal with unreasonable demands from antisocial forces.