Basic approach

Our Declaration of Conduct and Standards of Conduct, our sets of values and action guidelines that all officers and employees should share, stipulate that Credit Saison shall comply with all laws and regulations and take a firm stand against any behavior that deviates from these rules. We comply with laws and internal rules and carry out our business activities in an appropriate manner in all cases, aiming to enhance our corporate value and achieve sustainable growth while earning the trust of our stakeholders. We will continue to comply with the laws of countries where we operate and will strive to raise our employees' awareness of compliance.

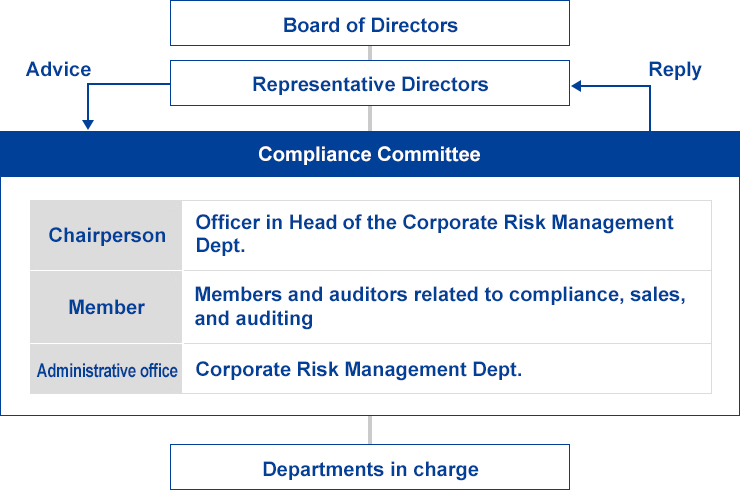

Structure

To promote compliance in a Group-wide manner, we have established the Compliance Committee, which is chaired by the officer responsible for Corporate Risk Management Dept. Activities of the Compliance Committee include approval of the Group-wide compliance promotion plan and training plan, reporting on their progress, and reporting on the status of compliance with each law.We have also assigned compliance officers and compliance staff in the respective departments. They are promoting compliance in their departments.These initiatives are reported to the Board of Directors on a regular basis. Additionally, the Audit Department audits the effectiveness and efficiency of business execution in each department and reports to the Board of Directors and the Representative Director.

Initiatives

Anti-bribery and anti-corruption policy

ー Entertainment and gifts in moderation

We comply with laws and prohibit any illegal payoffs (bribery). We also prohibit giving or accepting excessive entertainment or gifts even from a trade partner, affiliate, or similar party.

・Entertainment and gifts for public offices

We provide no entertainment or gifts to public civil servants or equivalents who are prohibited by law from receiving entertainment or gifts.

・Entertainment and gifts for business partners

We comply with the laws of the different countries and regions we operate within and avoid giving entertainment or gifts to business partners by implementing policies more restrictive than what may be acceptable in terms of social common sense.

Via our intranet and training programs, all of our employees remain correctly up to date on the information for limiting entertainment and gifts to an appropriately moderate level.

ー Political donations

We do not make political donations.

ー Ant-corruption initiatives

We prohibit any form of bribery or the offering of improper benefits. We provide no entertainment or gifts to civil servants of public offices or equivalents who are prohibited by law from receiving entertainment or gifts. We also prohibit giving or receiving excessive entertainment or gifts to or from trade partners. We will continue to raise awareness among all employees through educational programs using our intranet and other means to ensure that they do not give entertainment or gifts that deviate from common sense.

ー Spending related to anti-corruption

There is no serious violation of laws or spending for penal charges or settlement related to corruption.

ー Other

We have no expenditures relating to penalties specified in relation to ESG issues.

Response to Money Laundering and Terrorism Financing

To prevent money laundering and terrorism financing, the Company has established internal rules to ensure compliance with relevant laws, regulations, etc. and has put in place a system for implementing preventive measures.

It implements risk mitigation measures, such as filtering transactions at the time of business deals, in addition to identity verification based on relevant laws and regulations, and monitoring of transactions on a periodic basis after contracts are concluded.

It also strives to reinforce the system by improving employees’ knowledge by holding regular internal training sessions.

Response to anti-social forces

It is stipulated in our basic policy on measures against anti-social forces that we reject any relationships with anti-social forces, which threaten public order and social safety through organized crime, terrorist financing and other conduct, and maintain a firm attitude against them. We keep our employees thoroughly informed of this policy through regular training and other initiatives. When we start a new transaction or enter a similar situation in any of our businesses, we conduct sufficient investigations as to the level of social credibility of our trade partners and include a clause on the elimination of organized crime groups in the contract, so that we can cancel the contract ex-post facto if the trade partner should turn out to be anti-social forces.

Compliance with the Antimonopoly Act

We comply with the Antimonopoly Act. Our Standards of Conduct stipulate that we shall promote free and fair competition and business.

Prevention of insider trading

To prevent insider trading or similar misconduct, we have set out rules on the management of insider information obtained by our directors, executive officers and employees in relation to their duties and standards of behavior, in our insider trading management rules, thus managing insider information strictly. We also provide heads of departments with training two times a year on preventing insider trading.

Tax policy

ー Basic policy

We pay taxes appropriately by complying with the tax-related laws and regulations of each country and region where we operate. We understand that an appropriate tax payment contributes to the economic and social development of each country.

ー Measures related to Base Erosion Profit Shifting (BEPS)

We do not avoid tax intentionally by making use of tax incentives with measures not involving actual business activities or by using locations deemed to be tax havens.

International deals between Group companies are made by observing the OECD Transfer Pricing Guidelines.

ー Relationship with tax authorities

We provide information to tax authorities appropriately and respond to them faithfully in our efforts to build a sound relationship with them.

ー Management system

We have a governance structure in which the CFO assumes ultimate responsibility. The heads of responsible departments report the status of accounting and tax affairs appropriately.

People in charge of tax affairs consult external tax advisers in a timely manner in their efforts to ensure appropriate tax processing and reduce tax risk.

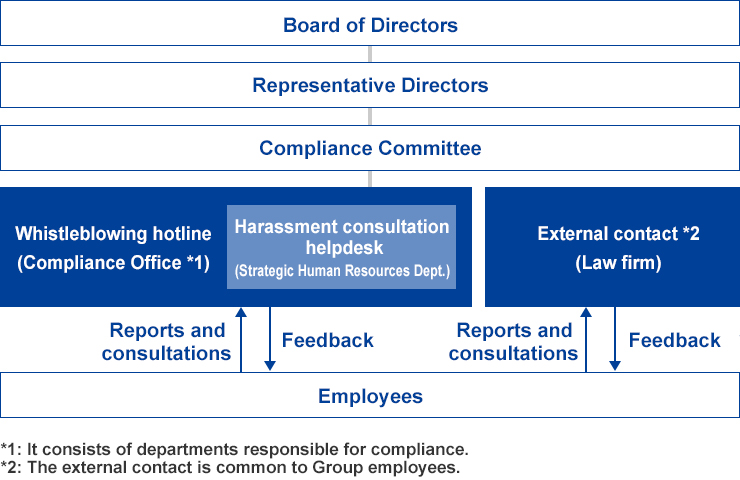

Internal reporting system

In accordance with the Whistleblower Protection Act, the Credit Saison Group has established an internal reporting system that can be used by Group employees.

Under the system, Group employees can report via email or post to a designated whistleblower hotline, which is administered by the unit responsible for compliance matters. Since December 2020, we have set up an overseas hotline for reporting from affiliated companies locating overseas. The hotline can be used in the language of each country. Consultation topics include fraud that violates laws, internal regulations, general social norms, and corporate ethics, harassment such as sexual harassment and power harassment, and workplace environment issues.

Reports can be made anonymously, the privacy of whistleblowers is protected, and the whistleblower rules clearly state that they will not suffer any retaliation or disadvantage for reporting. The operating status of the whistleblower system is regularly reported to the Compliance Committee. We also conduct compliance training according to rank, including training for department heads and other executive staff and new managers. We appoint compliance officers in each department and implement department-led training programs, in order to fully inform trainees about the system and the importance of compliance.