Basic approach

We aim to enrich the lives of our customers by providing a diverse range of services.

To ensure that all customers can use our services with peace of mind, we always listen to our customers, and work to manage personal information and build security infrastructure to guard against new forms of fraud.

- Responsible

service provision - Appropriate Management of

Personal Information - Information/cyber security

Responsible service provision

Basic approach

Based on our management philosophy, we improve our services by continually listening to customers and ensure safety so that customers can use our services with a peace of mind, thus contributing to customer satisfaction and to society.

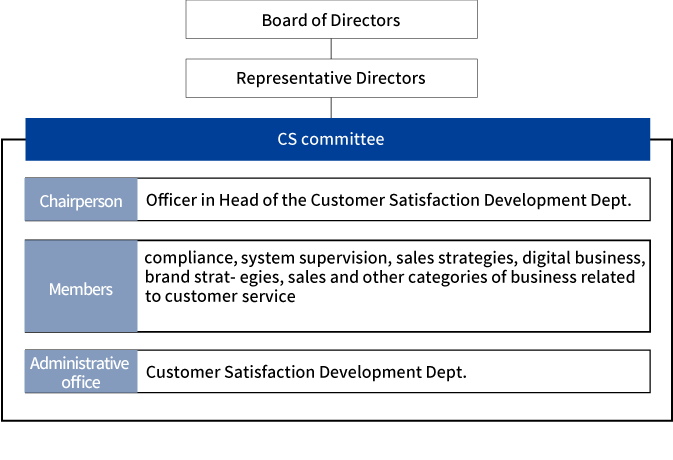

Structure

We believe that customer feedback, including opinions, requests and complaints, are valuable management resources, and we strive to improve our products and services based on the feedback we receive. The feedback from customers we receive via our call center, portal site, stores and other channels is shared with the relevant departments. Every month, feedback is reported to the heads of departments involved in customer services and the responsible officer, who discuss countermeasures. This enables our company-wide quality improvement efforts.

Initiatives

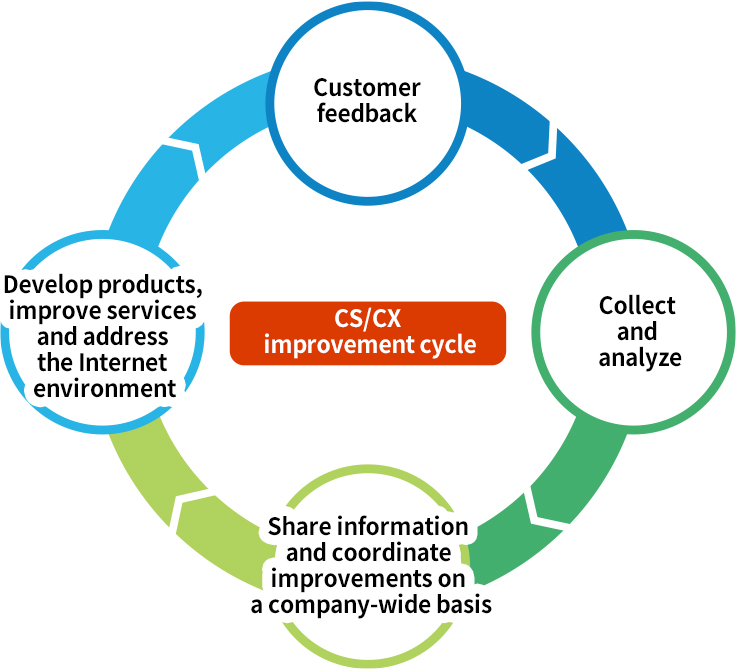

Valuable feedback from customers is shared throughout the company using the CS/CX improvement cycle and the feedback leads to the development of new products, the improvement of services and other positive results that enable us to meet the needs of customers.

・We analyze requests, comments, and compliments received via the Information Center, Saison counters, and other locations.

・We share customer feedback and needs with the entire company through important internal meetings, our intranet, and various other means.

・To meet the needs of our customers, we are working to develop new products, improve our services, create a more user-friendly online environment, and enhance the quality of our customer service as a whole.

- Examples of improvements utilizing customer feedback

With the recent increase in the number of fraudulent credit card charges, the security of cashless payment services has come under threat. In September 2023, we released the Net Answer investigation request acceptance function, to offer customers immediate peace of mind in the event that they receive a bill for a purchase that they do not remember making. While requests for investigations into fraudulent card use were previously only accepted by telephone via the Information Center, Net Answer now offers a speedy solution that takes as little as five minutes.

- Initiatives to improve the quality of customer service

◆ Provision of information in sign language

We have established a contact point at our Information Center where customers with hearing or speech impairments can ask about various procedures or make other inquiries via a video phone. The video phone enables smooth communication and timely guidance.

◆ Initiatives for universal manners and manners toward LGBT

We encourage employees to take the Universal Manner Test*1 to learn the “mindset” and “actions” that enable them to act from the perspective of someone different from themselves, such as an elderly person or a person with a disability. We also participate in LGBT*2 manner training*3, where we learn about the concerns and anxieties of the LGBT community, and learn specific knowledge and ways of dealing with the community in order to provide support.

- *1The Universal Manners Test is organized by the Universal Manners Association of Japan, and is a certification test for systematically learning and acquiring the ”mindset" and "actions" needed to deal with diverse people, including the elderly and people with disabilities.

- *2LGBT is a general term for sexual minorities and is an acronym for [L] lesbian (female homosexual), [G] gay (male homosexual), [B] bisexual, and [T] transgender (a person who lives or wants to live a gender different from the one assigned at birth).

- *3LGBT Manners Training” is sponsored by the Japan Universal Manners Association, and provides specific knowledge and ways to deal with the concerns and anxieties that the LGBT community tend to have, as well as points that can be taken into consideration and ways to provide casual support in the workplace and in services.

◆ Dementia supporter training lectures

Against the backdrop of Japan's aging population, we hold dementia supporter training lectures (online) constantly for all employees with a view toward creating a society where everyone can live securely in the community that is home to them. By ensuring that employees acquire the correct knowledge and understanding about dementia, we aim to improve their skills for supporting the many customers who have a stake in Credit Saison, not to mention people showing signs of dementia.

◆ Other, To improve the quality of our customer service, we conduct customer service training twice a month and encourage employees to take the universal manners test course and acquire Consumer Affairs Professional (CAP) certifications.

Appropriate Management of Personal Information

Basic approach

We recognize that the safe management of personal information is our most important responsibility, and comply with not only laws and regulations but also guidelines and industry rules. We have established our own internal regulations, and are working to maintain and improve our level of protection of personal information.

We have also published a Declaration on Handling of Personal Information, which declares that we will do our utmost to protect personal information.

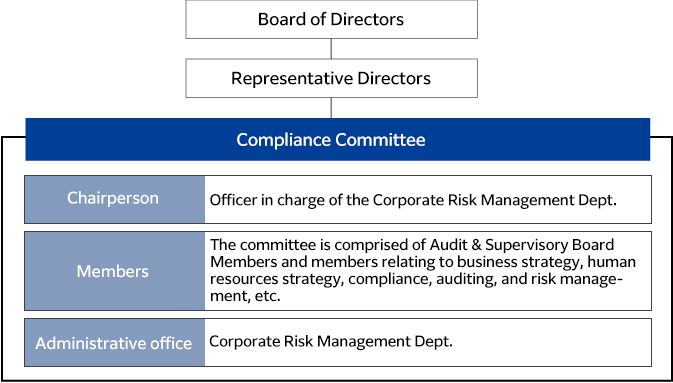

<Structure>

Initiatives

Regarding the handling of personal information, we are working to strengthen security through measures such as the use of dedicated lines, restrictions on people with access privileges, encryption of information, and entry/exit management of information terminal installation locations. In systems such as our shared core system that handles important data such as customer credit card information, we comply with PCI DSS, the global security standard in the credit card industry.In addition,In May 2006, Credit Saison was authorized to use the PrivacyMark, a certification given to businesses with appropriate systems for handling personal information.

- Preventing Excessive Indebtedness

We recognize that the most important issue is to pursue a balance between enriching our customers’ lives while contributing to economic progress on the one hand, and preventing people becoming multiple debtors through overuse. Therefore, we manage personal information appropriately and practice cautious lending and post-lending follow-up, to prevent people becoming multiple debtors.

Management and training

We have established internal corporate rules, and give our employees training in ethics. Our efforts to raise awareness of information management include the use of the “personal information manager” qualification established by the Japan Consumer Credit Association.

Information/cyber security

Basic approach

Based on our understanding that the appropriate management of information assets we own is an important task for businesses, we have established basic policies that our directors, executive officers, and employees should observe. We are committed to ensuring appropriate management of information, as well as the appropriate protection and management of information assets (hardware and software), and the ongoing maintenance and improvement of information security.

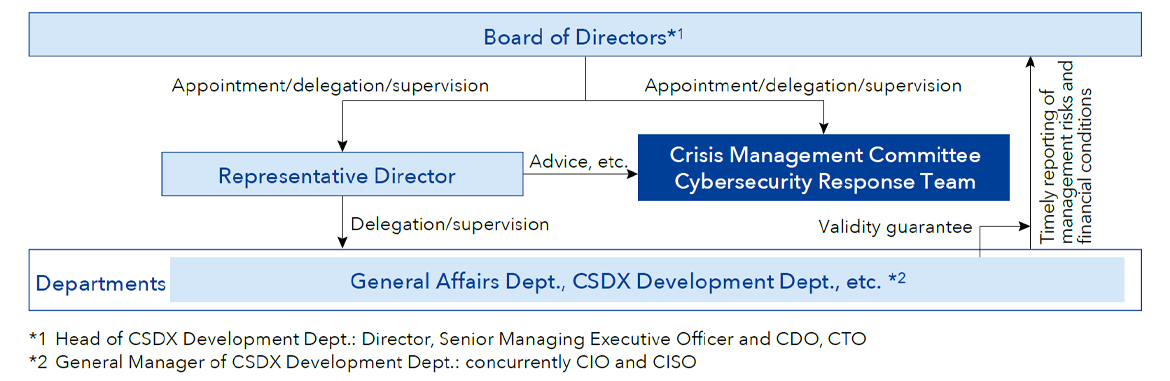

Structure

We maintain and comply with various regulations related to information security, including information management regulations, and are continuously reviewing our internal regulations to heighten our security level. Furthermore, we appoint the head of each department as a compliance officer and build and promote a system for promoting information security.

We have also set up the Cybersecurity Response Team as an organization within the Crisis Management Committee, which is under the supervision of the Board of Directors. Collecting information on security vulnerabilities, monitoring cyberattacks and other forms of trouble, and formulating response policies and procedures, the Team is working to establish systems that minimize the damage caused by an incident and then restore the situation. Responsibility for overseeing these initiatives rests with the CIO (and CISO), positions established within the CSDX Development Department that promotes cybersecurity measures, and with the director and senior managing executive officer responsible

Management and training

To ensure information security, regular audits are conducted by our internal audit department or external auditors, and security items are covered in audits conducted by Deloitte Touche Tohmatsu LLC. We also provide our directors, executive officers, and employees with information security training continually through various compliance training programs.

Initiatives

At Credit Saison, we strive to maintain stable operation of its web systems that handle important customer information, such as credit card applications and Net Answer. We use TLS/SSL (Transport Layer Security/Secure Socket Layer) encryption technology to protect the personal information of our customers. Along with striving to maintain stable system operations on a daily basis, we have formulated contingency plans such as securing backups of important systems to prepare for unforeseen events. In addition, for the purpose of detecting and improving system vulnerabilities, the IT Strategy Department takes a central role in conducting regular system risk assessments and, as a measure against cyber attacks such as targeted attack emails, the department takes measures such as fortifying firewalls and raising employee security awareness through simulated email drills to minimize damage in the unlikely event of an infection.

- Improving the accuracy of unauthorized use detection

We have built a more robust security infrastructure by combining our credit card credit assessment / credit screening know-how and experience, accumulated over the 70 years since our founding, with new systems developed in collaboration with partner companies.

Specifically, we are endeavoring to eliminate fraud in cashless payments from three directions: automation of fraud detection using AI, introduction of anti-spoofing technology, and detection of fraudulent devices. Through these efforts, we provide our customers with a safe and secure payment environment and contribute to the adoption of timely and contactless payment methods in this new era.

Secure payment environment in the cashless era

1 Automating fraud detection with AI

System for detecting unauthorized card use

The system uses AI (machine learning)-based fraud risk scoring model to identify and analyze transactions with a high risk of fraud and to prevent fraudulent use by third parties. Automatic learning of increasingly sophisticated fraud methods and early detection of the latest trends enable quick and highly accurate detection of unauthorized credit card use from a huge amount of transaction data.

2 Fraud prevention by means of device identification technology

Rogue device detection

This service detects fraudulent activities on the Internet by using technology that identifies every device used by the customer. Detecting and preventing fraudulent credit card applications and identity-theft shopping on the Internet eliminates anxiety about Internet transactions and enables the provision of safe and secure Internet services.

3 Face recognition technology to prevent identity theft

eKYC

LIQUID eKYC, a new identity verification service provided by Liquid Inc., which possesses biometric identity verification technology, allows customers to complete the sign-up process online by simply taking a picture of their identity documents and face image, etc. By combining this service with "Saison Connect", which links Saison's card information through an API, customers can use their credit card immediately with their smartphone (mobile payments) after completing the screening process without waiting to receive the plastic card.

Marketing policy

We ensure responsible marketing communication by complying with laws.

・We strive to ensure appropriate, easy-to-understand expressions and representations of our products and services so that they will not cause any misunderstanding among customers and trade partners.

・We protect personal information and will not use any expressions that will offend, discriminate, or exclude a specific individual, group, creed, religion, ethnicity, political orientation, or such like.

・We will not discredit other companies by giving false information about other companies' products and services to our customers or trade partners.

Social media policy

We strive to ensure the appropriate provision of information and communication via social media with the full understanding that social media are used by many and unspecified people and it is difficult to fully eliminate information that has been posted on or spread via social media. Please refer to our corporate website and press releases for our official announcements and views.

We observe our social media policy, which is stipulated in the following:

Financial inclusion

Aiming to contribute to regional economic development by achieving financial inclusion in emerging countries, we provide financial services through partnership with local companies, corporate venture capital business, impact investing business and more.