Corporate Governance

Our basic view on corporate governance, as well as the organizational design and structure

Basic approach

To realize our basic management policy of obtaining the understanding and approval of our stakeholders such as our customers, business partners, employees, shareholders, and society by continuously improving corporate value over time and creating innovative services, the Company is implementing a variety of initiatives to improve and strengthen its corporate governance in recognition of the enormous importance of enhancing management transparency and bolstering management supervisory functions to attain business objectives.

Please refer to the following reports for details of the Company’s corporate governance and related matters.

Securities Report (In Japanese only)

Corporate Governance Report

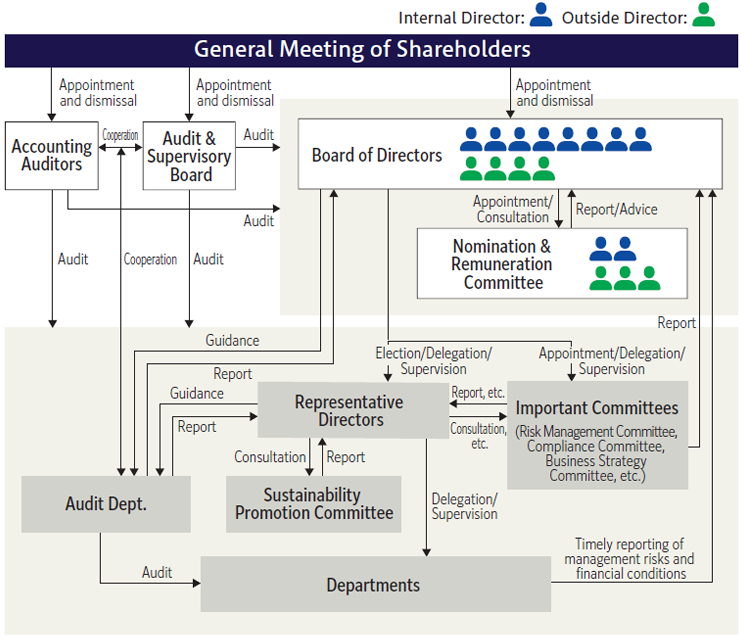

■ Corporate Governance Structure

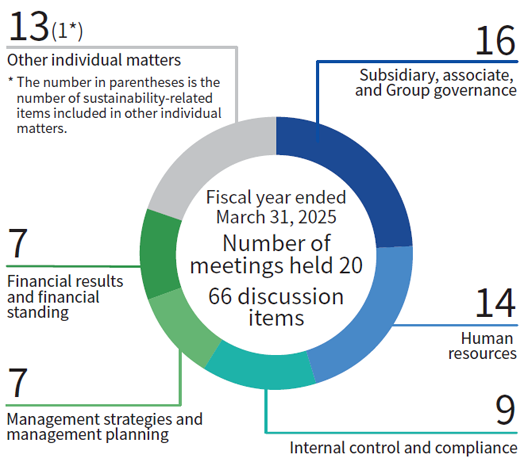

Board of Directors

The Board of Directors consists of 12 directors (including four independent outside directors). In addition to deliberating on important matters concerning management, the Board oversees the performance of duties by directors and actively exchanges opinions, including with outside directors, in order to ensure the effectiveness of decision-making and oversight. Outside directors provide useful advice and guidance on the Company’s management from an objective and neutral perspective.

For details of the ratio of outside directors and ratio of female directors, please refer to the sustainability data.

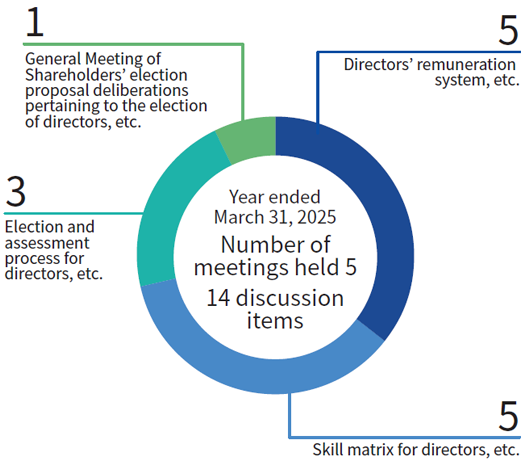

Nomination & Remuneration Committee

Established as an advisory body to the Board of Directors, the Nomination & Remuneration Committee is made up of directors elected by a resolution of the Board of Directors and is currently composed of five members, the majority of whom are outside independent directors and which include the Representative Chairman and CEO.

At least once a year, the Nomination & Remuneration Committee will deliberate on the following matters: (i) General Meeting of Shareholders’ proposals relating to the appointment and dismissal of Directors; (ii) the formulation of policies regarding remuneration, etc., to be received by Directors as well as standards for individual remuneration, etc., to be received by Directors; (iii) other matters on which the Nomination & Remuneration Committee provides its advice to the Board of Directors; (iv) the formulation, amendment, and abolishment of basic policies, etc., necessary for deliberating on the preceding items; and (v) other matters deemed of importance by the Nomination & Remuneration Committee. The Committee will also report the results of its deliberations to the Board of Directors.

Management/Executive system

Credit Saison has adopted the Audit & Supervisory Board (ASB) model.

The Company has established the Board of Directors, the ASB, and the accounting auditor as the corporate organization. To ensure the Company retains the confidence of its shareholders and other investors, the Company strives to improve and strengthen corporate governance by nominating outside directors and outside ASB members. The Board of Directors and Nomination & Remuneration Committee receive advice and recommendations from outside directors to ensure the appropriateness of business decision-making.

This enables directors, who are well versed in business matters, to maintain and improve management efficiency. In addition, the ASB is strengthening its management oversight function by coordinating with directors, executive officers, and others from the Internal Audit Office and the unit responsible for supervision of internal controls. At the same time, the Audit Department ensures its independence by having a direct reporting line to the Board of Directors, separate from reports to the Representative Director.

Credit Saison reviewed the composition of the Board of Directors and introduced an executive officer system in order to further strengthen its corporate governance system through the separation of business execution and management oversight. In doing so, the Company has put in place more appropriate management and supervisory functions and established an efficient business execution system. The term of office for directors is set at one year to ensure the Board can respond flexibly to changes in the business environment and to ensure that shareholders can have confidence in the Company’s management.

Overview of the Board of Directors’ effectiveness evaluation results

With the goal of improving the effectiveness of the Board of Directors, the Company, in principle, implements a self-evaluation based annual assessment and analysis for all directors and ASB members (including retirees before the expiration of their term of office) selected in the previous fiscal year. Questionnaires are given to each director and ASB member covering the following items, with the Board of Directors conducting discussions based on feedback from the results.

Assessment Items

(1)Composition of the Board of Directors

(2) Management of the Board of Directors

(3) Roles and Responsibilities of the Board of Directors

Overview of Assessment Results

We have confirmed that the Board of Directors is operating at a generally proper level and that the effectiveness of the Board of Directors has been secured.

With regard to the risk and compliance management system, which was identified as an issue in the evaluation of the effectiveness of the Board of Directors, the initiative policy of current issues and future policies was reported to the Board of Directors, and the Company reviewed important risks that are essential for the realization of the medium-term management plan and rebuilt a system to control them, based on (a) identification, evaluation, and analysis of risks based on risk assessments that refer to international standards; (b) identification of events that have become apparent; (c) individual interviews with directors, ASB members, and executive officers who are members of the Risk Management Committee; and (d) analysis of the external environment. In particular, in the area of information security, the Information Security Control Department was newly established to strengthen risk management and governance in this area by not only strengthening technical measures but also fostering Group-wide security awareness and formulating security policies, etc.

Credit Saison will continue to improve operations to further enhance the effectiveness of the Board of Directors, based on the recognition of operational challenges and roles and responsibilities identified, in order to further revitalize discussions aimed at enhancing corporate value with respect to the Board of Directors.

Examples of effectiveness evaluation initiatives ーRisk and compliance management system review processー