- Management Philosophy

- Credit Saison’s History of Business Transformation and Value Creation

- Value Creation Process

- Six Types of Capital

- Message from the Chairman

- Message from the Executive President

- Message from the Executive Vice President

- Transforming the Business Portfolio

- Overview of the First Year of the Medium-term Management Plan

- Second Year of the Medium-term Management Plan: Implementing and Verifying Efforts Aimed at Sustainable Growth

- Human Resource Strategy: Interview with the Executive Officer in Charge

- CSDX Strategy: Interview with the Executive Officer in Charge

- Sustainability

Sustainability

— Issues Faced by the Company, and Initiatives for Meeting the Expectations of the Future and Society —

Basic Stance on Sustainability

Being a “leading-edge service company” as stated in our management philosophy, we will continue to be committed to helping establish a society that is more convenient, prosperous, and sustainable than it is now by leveraging our unique expertise, management resources, and the experience of our employees and by contributing to the development of society and the resolution of problems in a way that only the Credit Saison Group can through its usual business operations.

Ongoing Support for Realizing Carbon Neutrality Using “ SAISON CARD Digital for becoz” to Visualize Individuals’ CO2 Emissions Based on Settlement Data

As the first credit card in Japan with the ability to visualize CO2 emissions, “SAISON CARD Digital for becoz” (hereafter, becoz card) was issued in June 2022 and recently celebrated its third anniversary this year.

Issued in a digital credit card format rather than as a plastic credit card, becoz card uses a dedicated mobile app to visualize CO2 emissions based on credit card usage history. By proposing “environmental value” as a new criterion for users to assess their personal lifestyles, Credit Saison supports consumers who aspire to a carbon-neutral lifestyle.

Interview with employees involved in becoz card

- Mr. Tanaka, becoz card was released when you were a member of the Corporate Planning Department. Can you tell us about the background behind its conception and the response from those around you?

-

We began considering the concept in 2021 after the president saw a newspaper article about DATAFLUCT, Inc., which is one of our business partners today.

Although we developed this service in cooperation with DATAFLUCT as an initiative for potentially reducing CO2 emissions together with customers who have links to Credit Saison’s business, some in the Company felt the idea was too far ahead of its time. This put us in a position where we struggled to gain support, so the journey for this project was not necessarily smooth. After overcoming countless challenges and releasing the service in June 2022, however, the project won various accolades from society, including the grand prize in the “NIKKEI Decarbonization Awards (project category),” as well as the grand prize in the “Japan Financial Innovation Award 2023.” In line with increased awareness and use as well as the uptick in media coverage, successful steps are being taken to realize a sustainable society. - Ms. Takahashi, you have been involved in becoz card through your participation in the Eco-business Task Force since FY2024, correct?

- I have always been interested in environmental issues, so I was thrilled when Credit Saison announced a credit card that took on the issue of climate change three years ago. I applied without hesitation the moment I learned of this task force through the internal recruitment system, which I check on a regular basis. Amid the different themes the task force was tackling, I chose to work on becoz card because I felt that while it offered various possibilities, it deserved more and still lacked name recognition. As I engaged more closely with the team members, I recognized that my thoughts and those of the other members were closely aligned.

- As you proceeded with the market survey and analysis for becoz card, did you notice anything?

- What I found really interesting was that unlike our other credit cards, becoz card received particularly strong support from males in their 30s and younger. I felt deep significance in the fact that we were using a tool as familiar as a credit card to increase awareness toward the environment in people’s everyday lives in a way that tracks different lifestyles across a broad demographic, including younger generations.

- Ms. Wakamatsu, as General Manager of the Sustainability Department, you also serve as the secretariat of the Sustainability Promotion Committee. How do you want to develop becoz card going forward?

- Even as more and more of our customers become interested in environmental issues, I still receive comments to the effect that people do not know where to begin. The reason becoz card was conceived three years ago was in part to provide a gentle push to these people as a trigger that would change their behavior. We will continue to support the aspiration of customers to do something about the global environment and to find solutions to global environmental issues together with as many people as possible.

Credit Saison is promoting initiatives that prioritize the development of future generations along with diversity, equity and inclusion (DE&I), while balancing a global perspective with contributions to local communities.

Our Approach to Create a Positive Impact

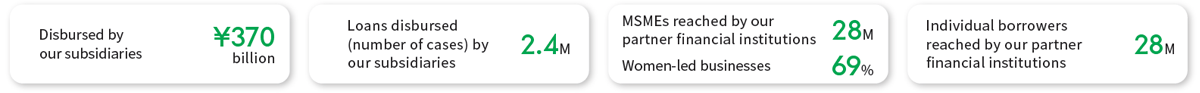

The Credit Saison Group started our impact business in 2021. The initial team of 2 were formed and it has grown into a six -member team representing five nationalities and operating from five locations (including two experts) in the following year. The team strives every day to expand the Group’s positive impact with the aim of realizing financial inclusion.

Driving impact and ESG leads to sustainable growth

Impact investment provides access to financial services to individuals and enterprises (underserved populations). Working in partnership with FinTech companies and microfinance institutions, these efforts not only support sustainable growth and ESG enhancement of our investees and borrowers; they also contribute to our own growth. Team members are working hard to solve social problems and making positive changes in their respective markets, and they will share their thoughts on this initiative.

- While we have spent the last couple of years building the foundations of our ESG and Impact management practice, I am now looking forward to expanding the depth of our Impact practice and achieving greater operational effectiveness. Specifically, where efforts will be put on upskilling our team and onboarding topic experts, but also focusing on efficiency and data-informed decisions, managing the evolving regulatory requirements, aligning more directly with business strategies and client demands, and finally by nurturing our genuine commitment to impact. Our ambition is to be able to demonstrate our leadership and enhance the breadth of our impact practice in the near future. When we formulated the Mission, Vision, and Value (MVV) statement that outlines the common values of the Global Business which reflects employee’s thoughts and our evolving corporate culture, We strategically incorporated the concept of “impact.” It seems revolutionary to me that impact has become an important pillar for us.

- The impact market in Japan has undergone a notable transformation, with assets under management nearly doubling over the past year. In my experience during due diligence, each time I see how impact investing changes lives, I’m reminded that impact is not a mere metric—it transforms people’s lives. When a woman entrepreneur secures her first formal financing, or when we see children able to attend school due to our support, I feel the power of financial inclusion.

- In Indonesia, the impact market has changed dramatically over the past three years—moving from a niche topic to an issue of national priority. Players have increased and momentum is building across the country. For me, impact work begins with empathy, sustains curiosity, and challenges the status quo. It is where ideals meet action, and we need more people who share this mindset. I therefore intend to establish a more robust impact ecosystem going forward.

- The Indian impact market is driving the global market in part due to the tailwind from the regulatory environment. On the other hand, it is still a relatively new concept for many market stakeholders, so effectively conveying its importance and working through cooperation still has a long journey ahead. I work daily to ensure everyone recognizes its important role as a driver for long-term value creation and as a strategic risk management tool.

- While Kisetsu Saison Finance (India) Pvt. Ltd. (hereafter, Credit Saison India) lends to as part of India's non-bank sector, I was originally on a recipient side. After joining Credit Saison India and shifting to the lender’s side, which has allowed me to see first-hand the transformational power that financial inclusion has to transform people’s lifestyles and the community. I always keep in mind the reality that borrowers are faced with, as we strive to strike a careful balance between financial prudence and measurable impact creation.

- When you think about the significance of our commitment to impact, there probably isn’t anyone who would stand against the positive outcomes for society and the environment. Leveraging our Group’s practical, investor-minded framework and its ambition for business growth and scale, I am excited to work with a young, forward-looking team. I feel it is a great opportunity that allows me to support a Japanese company engaging in global business.

* As of March 31, 2024

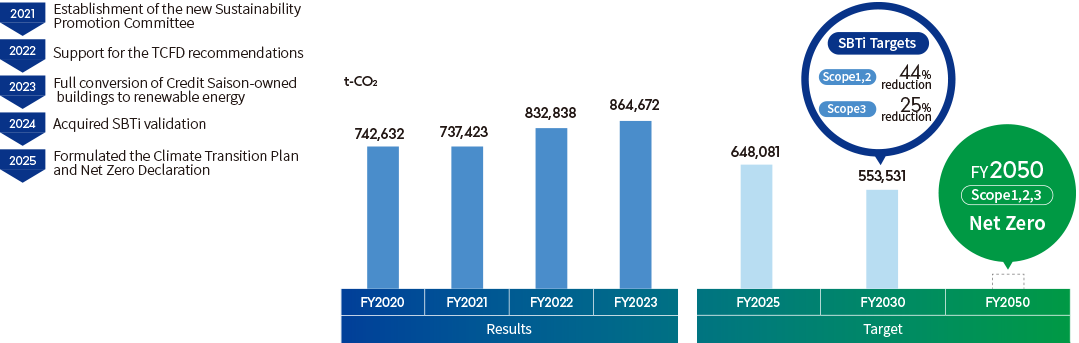

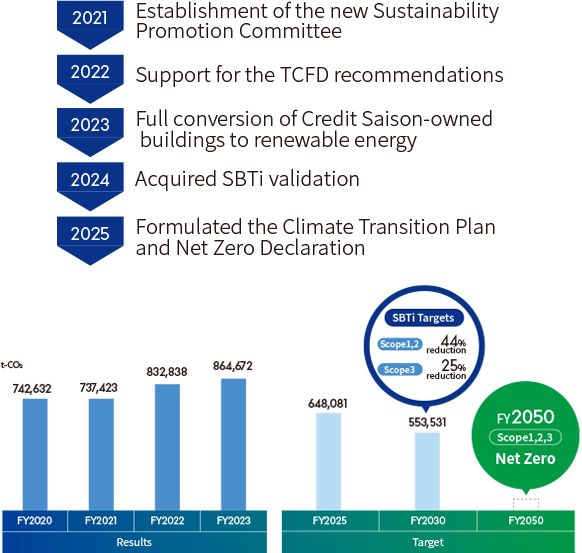

Toward Net Zero Carbon Emissions

In order to accelerate the reduction of the environmental impact of our corporate activities toward a sustainable future, we formulated the Climate Transition Plan, under which we will strengthen our initiatives to achieve net-zero greenhouse gas emissions by FY2050.

Initiatives for Future Generations

Credit Saison conducts CSR activities and financial education programs for children, students, and others in Japan and abroad who will take responsibility for the coming future. In addition, we are also working to pass on the beliefs of our founder through initiatives that seek to preserve nature for future generations.

Proactive CSR Activity Initiatives (India)

As our subsidiary in India, Kisetsu Saison Finance (India) Pvt. Ltd., donates a certain percentage of its earnings for the purpose of fulfilling its social responsibility.

One of the NGOs it donated to in FY2024 administers a facility where the elderly, women, and children can stay with peace of mind, thereby supporting a sanitary environment where 30 children can stay in safety and health through these donations. Seeing children who before coming to the facility spent their days feeling anxious now talk about how they have dreams for the future leaves a strong impression. Kisetsu Saison Finance will continue to actively expand the number of organizations it supports.

Financial Education Initiatives (Japan, Singapore)

Along with its subsidiaries in Japan and overseas, Credit Saison continues to provide financial education for future generations to various stakeholders. Centered on our “SAISON TEACHER” on-site workshops for middle and high school students, in Japan we offer financial education programs in which our employees serve as instructors (held 672 Classes in FY2024 for approx. 29,000 attendees). In FY2024, we held “Welcome Kids Day–Does money really grow ?!” programs where the children of our employees visit workplaces under the guidance of volunteers. As part of this program, children experience investing through original games for elementary and middle school students, thereby providing them with the chance to learn that money can be grown. Participants shared that their children became interested in investing after experiencing firsthand how money can support companies and how it grows.

Akagi Nature Park: Initiatives to Preserve Nature for Future Generations (Japan)

Our Akagi Nature Park, in Shibukawa City, Gunma Prefecture, has spent roughly four decades regenerating a mixed forest while striving to maintain the ecosystem and manage vegetation. The park engages in plant conservation and planting activities that create a forest that takes into consideration biodiversity, including the distribution of groundwater throughout the park to replenish rivers and ponds that enrich the entire area. Survey results have confirmed that the Satoyama ecosystem is well maintained, which contributes to the preservation of biodiversity. The park has also been certified as a forest therapy site, and as a best practice under the Gunma Prefecture Nature Positive Promotion Platform.

Human Rights Initiatives

Credit Saison formulated our “Action Declaration” and “Behavioral Standards,” and included respect for human rights as one of the principles for action. In order to strengthen the infrastructure for realizing our management philosophy of being a leading-edge service company, we are advancing human rights initiatives and aim to create an organization and society in which everyone respects each other’s diversity.

In September 2024, we conducted a training program attended by 220 people to deepen the understanding of unconscious bias for those in management positions. In FY2023, we held a similar training program for all executives and general managers, and will implement measures to foster a greater understanding of this issue across all other levels of the Company from FY2025 on. Going forward, we will go beyond internal initiatives to implement human rights due diligence and further strengthen our efforts in this area.