- Management Philosophy

- Credit Saison’s History of Business Transformation and Value Creation

- Value Creation Process

- Six Types of Capital

- Message from the Chairman

- Message from the Executive President

- Message from the Executive Vice President

- Transforming the Business Portfolio

- Overview of the First Year of the Medium-term Management Plan

- Second Year of the Medium-term Management Plan: Implementing and Verifying Efforts Aimed at Sustainable Growth

- Human Resource Strategy: Interview with the Executive Officer in Charge

- CSDX Strategy: Interview with the Executive Officer in Charge

- Sustainability

Overview of the First Year of the Medium-term Management Plan

As the first year of the three-year Medium-term Management Plan,

FY2024 was a year in which Credit Saison aimed to evolve into a “GLOBAL NEO FINANCE COMPANY” and

endeavored to strengthen its foundation.

Overall Review

A year of redefining and implementing our “earning power” to achieve the ¥100.0 billion business profit target

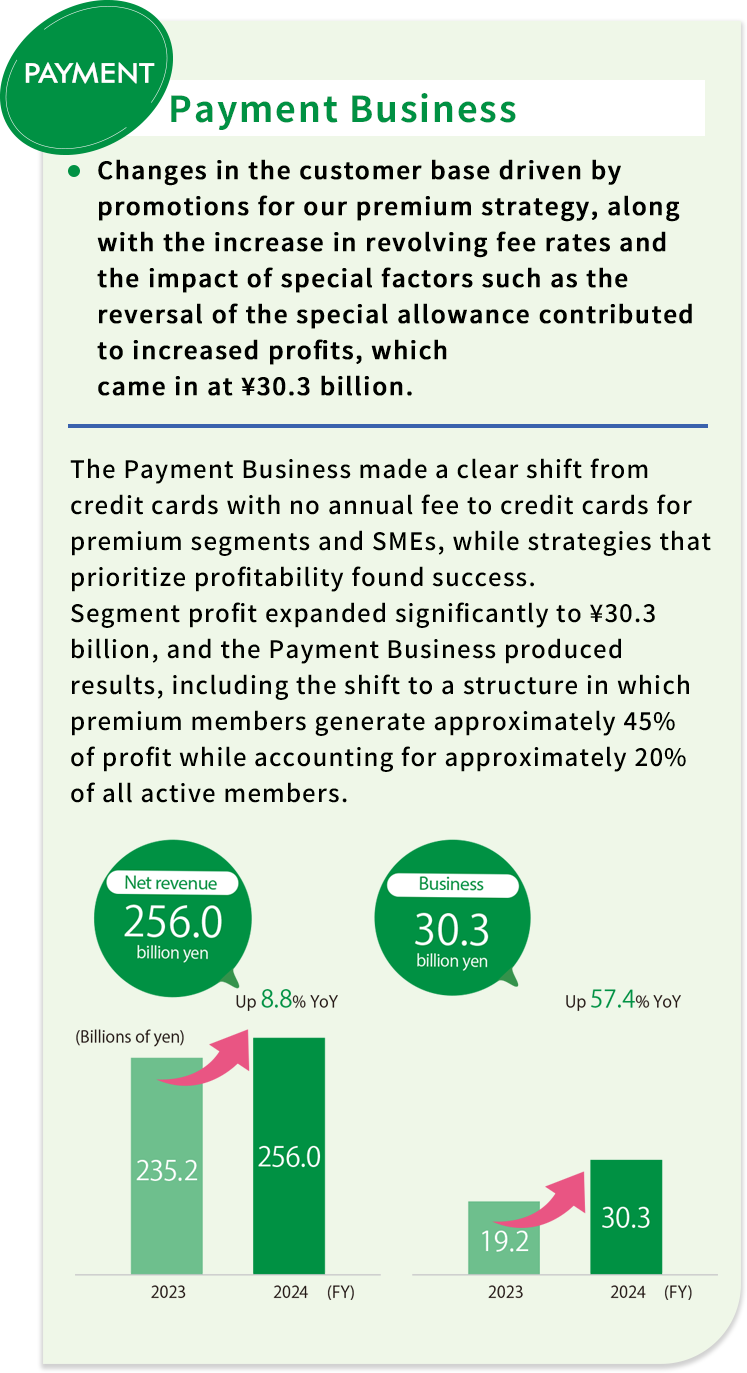

During the first year of the Medium-term Management Plan, Credit Saison committed to strengthening the foundation of each strategy.

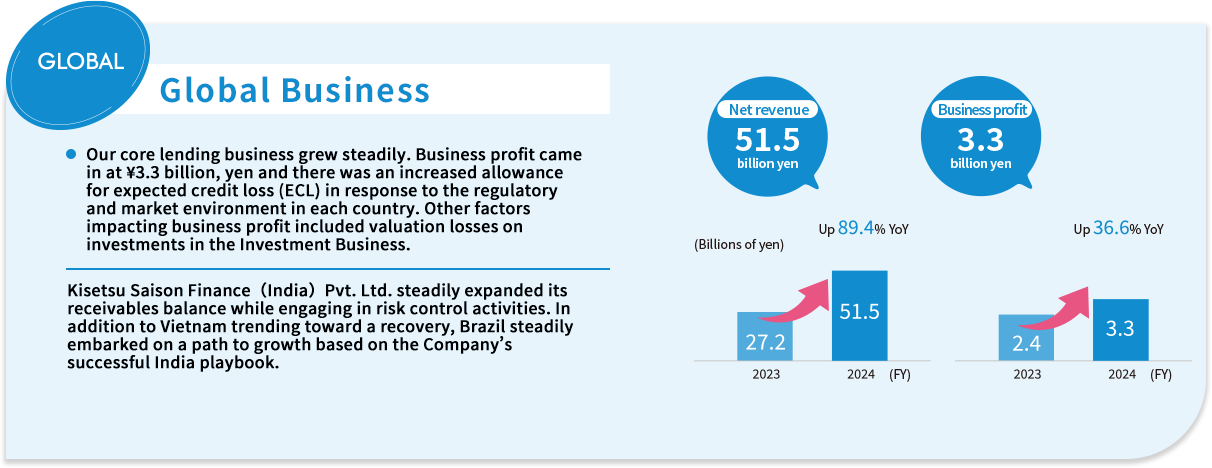

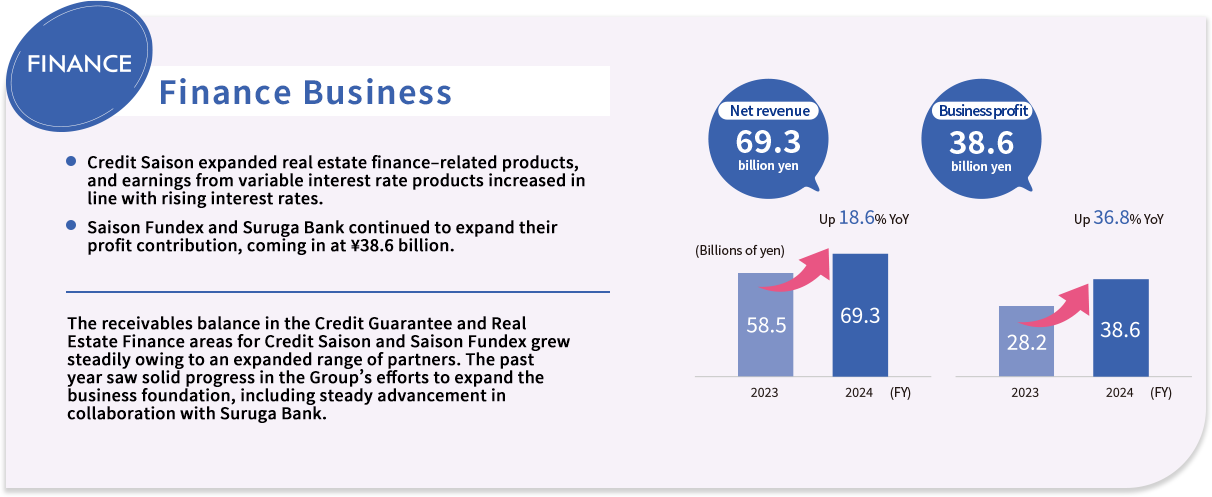

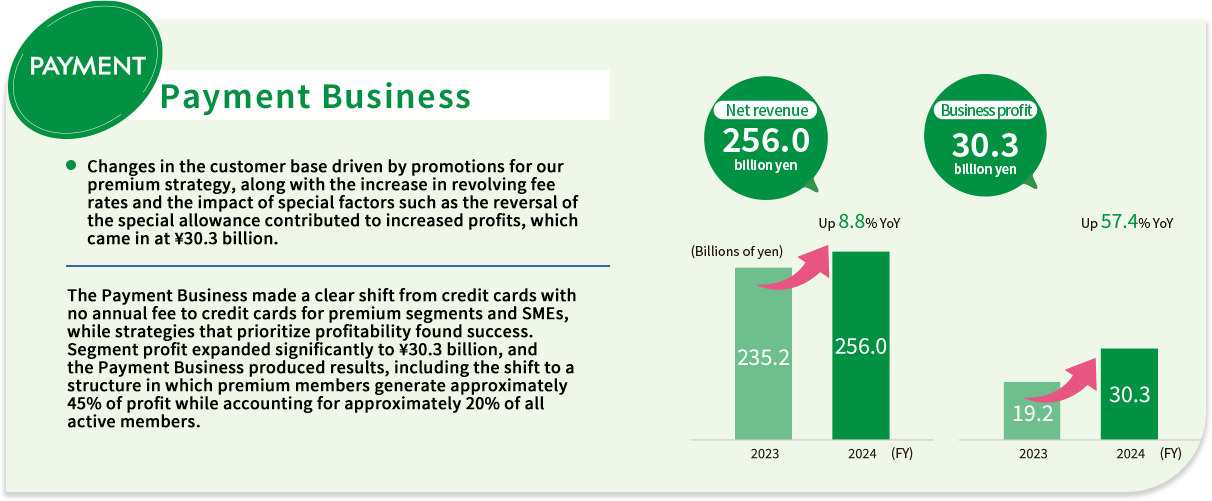

Specifically, we worked to deploy various strategies under four priority themes: (1) Thoroughly bulk up domestic businesses; (2) Utilize banking functions to accelerate each business and strengthen financial functions; (3) Evolve unique global development starting from India and create bidirectional fusion between Japan and overseas; and (4) Business strategy–linked employee growth and strengthen the management base. Along with steady growth in the domestic Payment and Finance businesses, expansion in the Global Business as our third core business and other positive trends in each segment drove consolidated business profit to a historic high of ¥93.6 billion. Moreover, having announced our approach to achieving management that is conscious of the cost of capital and the stock price, we advanced a capital policy aimed at achieving a PBR of more than 1. Of the ¥70 billion target for share buybacks under the three-year Medium-term Management Plan, we acquired ¥50 billion in treasury shares during the first fiscal year. In addition to presenting a policy for acquiring the remaining ¥20 billion during the second year, we made steady progress in our policy of achieving reductions equivalent to 70% of cross-shareholdings.

FY2024 Financial Results Summary

- Profits decreased due to the impact of recording an amount equivalent to gain on negative goodwill due to the conversion of Suruga Bank into an affiliated company accounted for by the equity-method application to Suruga Bank in the previous fiscal year as investment profit under the equity method.

- Results excluding negative goodwill