- Management Philosophy

- Credit Saison’s History of Business Transformation and Value Creation

- Value Creation Process

- Six Types of Capital

- Message from the Chairman

- Message from the Executive President

- Message from the Executive Vice President

- Transforming the Business Portfolio

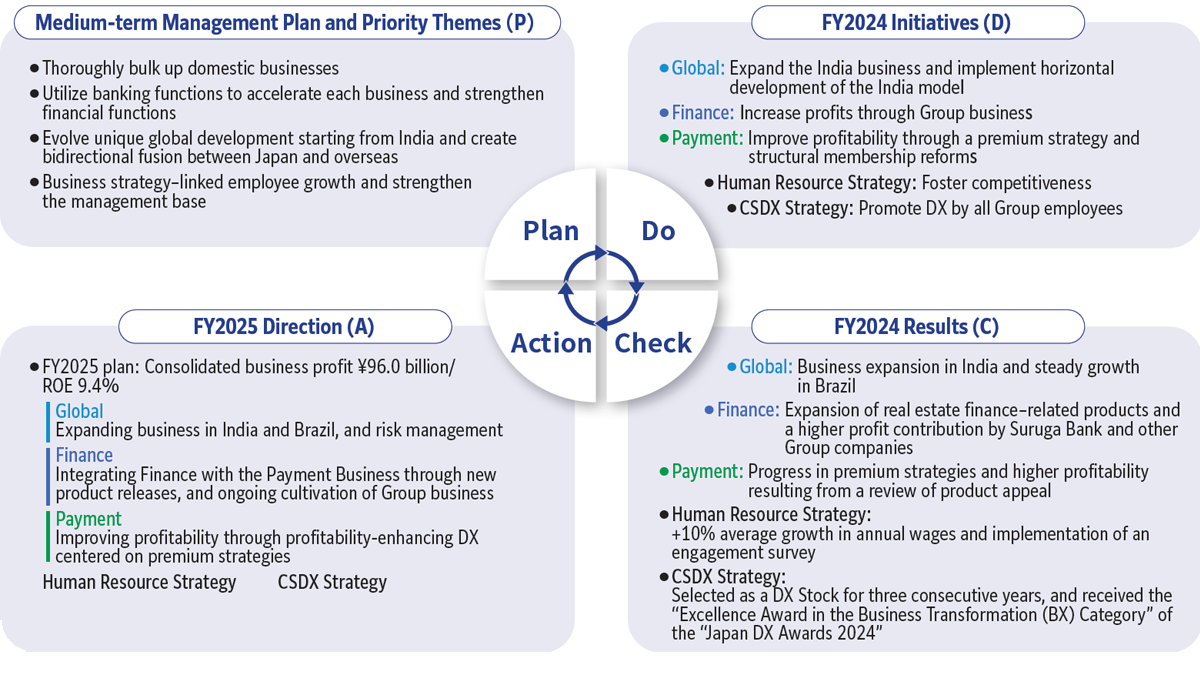

- Overview of the First Year of the Medium-term Management Plan

- Second Year of the Medium-term Management Plan: Implementing and Verifying Efforts Aimed at Sustainable Growth

- Human Resource Strategy: Interview with the Executive Officer in Charge

- CSDX Strategy: Interview with the Executive Officer in Charge

- Sustainability

Second Year of the Medium-term Management Plan: Implementing and Verifying Efforts Aimed at Sustainable Growth

Enhancing “sustainable growth potential” with the aim of evolving into a robust business model and management base for the future

Achieved Record High Profit in FY2024. In FY2025,

We will Work to “Accelerate Growth on the Basis of Merit.”

When looking at FY2024 in terms of consolidated business profit, we achieved a record high ¥84 billion excluding the special allowance, showcasing that our “earning power” has strengthened. In FY2025, we will work to achieve consolidated business profit of ¥96 billion while eliminating special factors from the previous fiscal year and fending off the impacts of interest rate hikes. Moreover, to accomplish our evolution into a robust business model and management base for the future, we will strive to enhance “sustainable growth potential” with an eye to the final fiscal year of the Medium-term Management Plan and beyond.

FY2025 Progress Update

Released in August 2025, first-quarter financial results indicated higher revenue and profit, with net revenue of ¥108.9 billion and business profit of ¥22.9 billion. On the other hand, quarterly profit declined ¥16 billion due to the recording of impairment losses associated with the sale of a portion of Suruga Bank shares. Although we will revise the segment plans in response to the differences in performance for each segment due to the rebound from the previous fiscal year and special factors, we will continue to pursue efforts aimed at achieving the planned consolidated business profit target for the full fiscal year, which remains unchanged at ¥96 billion.

Capital Policy

Under our capital policy, we have made steady progress in the various initiatives raised in the Medium-term Management Plan and had undertaken the acquisition of ¥61.5 billion in treasury shares (87.9% progress rate) as of the end of July 2025. In terms of reductions equivalent to 70% of cross-shareholdings, our progress rate reached 58.7%. Moreover, under our policy of delivering stable and continuous dividends, in FY2025 we expect to increase the dividend for a fifth consecutive year to ¥130 per share, a level that stands approximately three times above that from five years ago. We will continue our efforts in a bid to secure a payout ratio of at least 30%.

Summary

To achieve our vision for 2030 to become a “GLOBAL NEO FINANCE COMPANY,” we will work diligently to reach our consolidated business profit target of ¥100 billion and a PBR of more than 1 in FY2026, the final fiscal year of the Medium-term Management Plan. In light of this, we are striving to enhance corporate value. To move beyond the scope of a simple finance company, we will continue to drive forward with the goal of emerging as a presence that achieves synergy on a global basis through the “Saison Partner Economic Zone” in which we create partnerships.