We are expanding our lending and investment business in various regions, primarily India, Southeast Asia, and Latin America, with the goal of achieving financial inclusion.

Top Message

Our Global footprint

Since establishing our regional headquarters in Singapore in 2014, we have been expanding our business primarily across Southeast Asia. In 2018, we established a subsidiary in India, which has been growing steadily driven by locally led and technology first strategy.

In 2023, we entered the Latin America market, drawing on and applying the experience and expertise we gained in India.

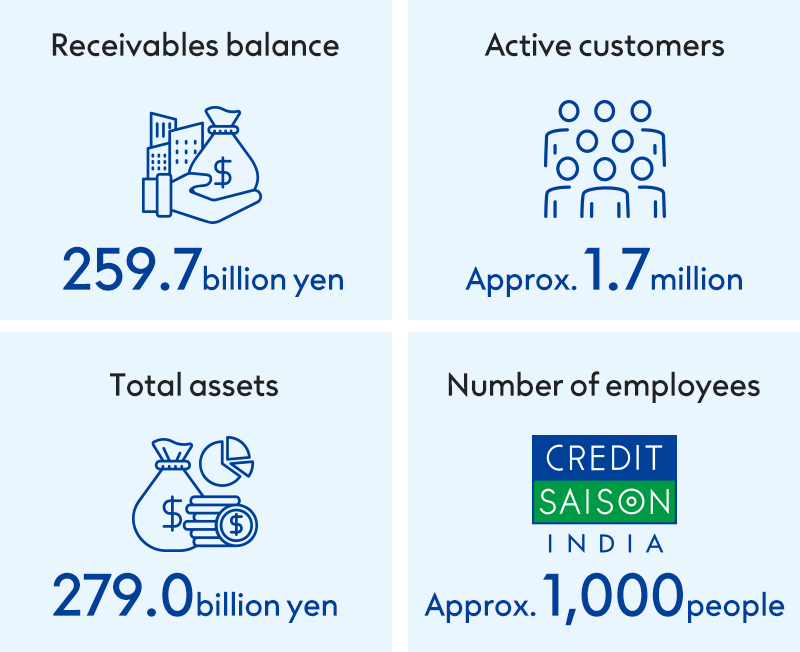

Credit Saison India

Kisetsu Saison Finance (India) Pvt. Ltd. (hereafter, Credit Saison India) commenced operations in 2019. Since then, the company has focused primarily on wholesale lending to local NBFCs and co-lending with fintechs. Credit Saison India is also accelerating business diversification, and has now started direct lending to SMEs, through 95 locations in 68 cities across India.

Going forward, Credit Saison India will continue to invest in new growth opportunities while maintaining strict risk management, aiming to become a leading NBFC in India.

Our Product

- ・Wholesale lending (loans to local NBFCs)

- ・Partnership lending (loans through tech enabled alliance with fintechs)

- ・Embedded finance (loans through tech enabled alliance with non-financial companies)

- ・Branch lending (loans to SMEs utilizing branches)

History of Credit Saison India

- 2018

- Established

- 2019

- Obtained an NBFC license

launched wholesale lending - 2020

- Launched partnership lending

- 2022

- Launched branch lending

Rated AAA by CARE * - 2023

- Rated AAA by CRISIL *

Launched embedded finance - 2024

- Investment from Mizuho Bank, Ltd.

- 2024

- Launched Loans Secured by Property (Loan against property)

* Long-term credit rating by credit rating agency in India

* As of September 2025

| Company Name | Business Description | Established |

|---|---|---|

| Saison International Pte. Ltd. |

Overseas business development and overall management of overseas Group companies (IHQ) | May 2014 |

| Kisetsu Saison Finance (India) Pvt. Ltd. |

Lending to individuals and small and medium enterprises in India | June 2018 |

| Credit Saison Brazil Participações Ltda. |

Lending to small and medium enterprises in Brazil | February 2023 |

| Credit Saison Mexico S.A. de C.V., SOFOM E.N.R. |

Lending to small and medium enterprises in Mexico | March 2023 |

| PT Credit Saison Indonesia Finance |

Lending to individuals and small and medium enterprises and P2P lending in Indonesia | September 2015 |

| Saison Investment Management Pte. Ltd. |

Offshore lending business based in Singapore that provides loans to emerging economies | September 2021 |

| Saison Capital Pte. Ltd. |

Investment in overseas startups, primarily in the field of fintech | June 2019 |

| Saison Crypto Pte. Ltd. | Investment in startups in the field of Web3 | September 2022 |

| HD SAISON Finance Co., Ltd. |

Retail finance in Vietnam | May 2015 * |

| Julo Holdings Pte. Ltd. |

Lending to individuals in Indonesia | April 2022 * |

*Year of investment by the Company

Our Vision for Global Business

We all embrace common values and philosophy amid diversity, and continue to take on challenges together as a united group.

Vision

To be a transformative partner in creating opportunities and enabling dreams.

Mission

We bring people, partners and technology together, to create resilient, innovative financial solutions for positive impact.

Values

We believe in act with INTEGRITY, foster INCLUSION, lead with INNOVATION, deliver with IMPACT.

Our Global Strategies

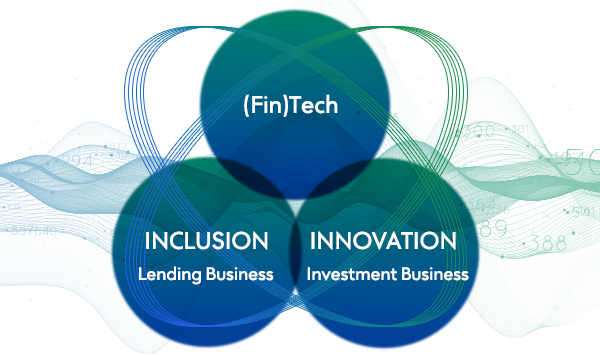

To create a world where everybody can access financial services without anyone being left behind (financial inclusion) we drive two core businesses—lending and investment— centered on FinTech.

FinTech-led INCLUSION and INNOVATION

Lending Business

- We provide loans to the underserved* in India, Southeast Asia, and Latin America.

- By partnering with local entities, We create our own economic zone and deliver services that tailored to local market.

Investment Business

- We invest in promising startups and venture capital funds primarily in the fields of FinTech and Web3.

- Through investments in cutting-edge technologies, we aim to create synergies with the existing businesses.

* Individuals and companies who are unable to effectively access existing financial services or feel financially inconvenienced due to economic, geographical, or infrastructural barriers

Latest Strategy of the Global Business

Held on June 7, 2024 Global Strategy Briefing

- Presenter:

- Kosuke Mori, Director, Senior Managing Executive Officer , Head of Global Business Division

Back Number

Our Impact Initiatives

We contribute to our corporate vision of realizing a "sustainable society that is even more convenient and more prosperous," by generating social positive impacts through the lending business in each country.

Here we introduce our impact initiatives together with the voices of customers' stories.