Worldwide, the severity of climate change and other global environment issues is increasing. Japan is no exception. Weather abnormalities have caused many large natural disasters and have greatly impacted Japan. Companies cannot overlook the impact of climate change. Against this backdrop, we believe that climate change is an important issue we should address in our sustainability-oriented management, and that the risks and opportunities accompanying climate change will greatly impact our business strategies.

The Company expressed its support for the Task Force on Climate-related Financial Disclosures (TCFD) recommendations in 2022 and is involved in the TCFD consortium, a discussion forum for the companies and financial institutes supporting the recommendations.

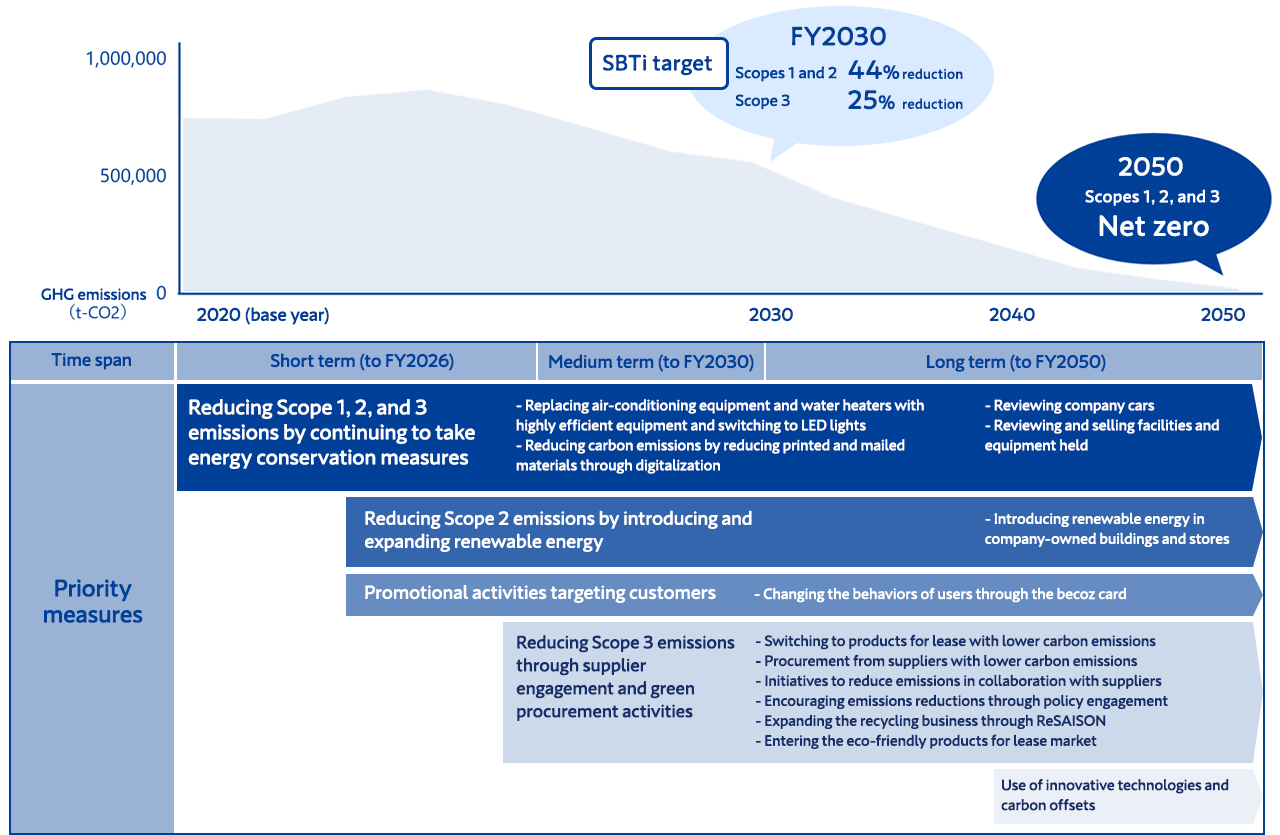

In 2025, in order to accelerate the reduction of the environmental impact of our corporate activities toward a sustainable future, we formulated the Climate Transition Plan and launched initiatives to achieve net-zero greenhouse gas emissions by 2050.

We will continue to promote disclosure of information on our response to climate change based on the TCFD recommendations and the new SSBJ standards, thereby contributing to the realization of a sustainable society.

Recommended disclosure items based on TCFD recommendations

Governance

The Sustainability Promotion Committee was established in August 2021 and promotes activities related to climate change.

Being a "leading-edge service company" as stated in our management philosophy, we have a basic aim of helping establish a society that is more convenient, enriched and sustainable than it is now by leveraging our unique expertise, management resources and the experience of our employees and by contributing to the development of society and the resolution of problems in a way that only Credit Saison can through its usual business operations.

Taking action to address sustainability-related issues such as the consideration of climate change and other global environmental issues, respect for human rights, the health and working environment of employees, the fair and appropriate treatment of employees, fair and appropriate trade with suppliers and crisis management to handle natural disasters and other events is very important in our management of our business. These actions help mitigate risks and create revenue opportunities. Based on this understanding, the Sustainability Promotion Committee was established in August 2021 as an organization for discussing the direction of our activities to achieve our sustainability-related strategies and to respond to inquiries from the representative director.

In October 2023, with a view toward advancing our businesses and undertaking corporate activities to further support sustainable economic development, and fusing these activities with our DNA to become a truly unique global company Originated in Japan, the chairperson of the Sustainability Promotion Committee was replaced by the Director and Senior Managing Executive Officer in charge of Global Business. In addition, the new Sustainability Dept. was established in March 2024, and company-wide efforts have been made to strengthen our climate change initiatives.

• Roles of the Sustainability Promotion Committee

As an advisory body to the Representative Directors focused on sustainability activities, the Sustainability Promotion Committee is strengthening our initiatives to solve social and environmental issues through our business in a Group-wide manner.

With the Representative, Executive President and COO participating as a member of the Committee, the Committee consists of members chosen from inside and outside the Company with consideration to gender equality and a global mindset, which facilitates exchanges of diverse opinions. In addition, the Committee develops plans for and confirms the results of important sustainability-related tasks, including the assessment and management of climate change risks and opportunities, and reports the status of these tasks to the Board of Directors once a year.

The Committee has three working groups: the Climate Change Strategy Promotion WG(*1), the DE&I (Diversity, Equity & Inclusion) Promotion WG and the Social Impact WG. Reporting to and receiving instructions from the Committee, the working groups periodically respond to questions from the Representative Director regarding the sustainability strategies and initiatives introduced throughout the Credit Saison Group, and report on these matters to the Board of Directors when necessary.

- *1. Working group (the same hereinafter)

• Supervisory responsibility of the Board of Directors

The Board of Directors is responsible for supervising sustainability-related matters.

The Board of Directors receives reports from the Sustainability Promotion Committee about important issues including the status of the implementation of the climate transition plan and the results of deliberations. It also receives reports about the sustainability strategies proposed by the Business Strategy Committee which consists of Directors and Executive Officers and the status of the dialogues with domestic and overseas institutional investors, including dialogues about sustainability information and other matters. The Board of Directors supervises the achievement of sustainability-related targets.

For those who have been selected to be Directors include people with knowledge of ESG-related issues, including climate change.

<Sustainability Promotion Committee organization chart>

<Sustainability Promotion Committee Members>

| Chairperson | Kosuke Mori Director, Senior Managing Executive Officer |

|---|---|

| Members | Katsumi Mizuno Representative, Executive President and COO |

| Shunji Ashikaga Director, Managing Executive Officer |

|

| Yumiko Hoshiba Outside Director |

|

| Ryuki Tabata Managing Executive Officer |

|

| Kazue Yasumori Managing Executive Officer |

|

| Naoki Misaka Executive Officer, General Manager of the Corporate Planning Dept. |

|

| Yuka Wakamatsu General Manager of the Sustainability Dept. |

Criteria for selection of members of the Sustainability Promotion Committee

- ・The chairperson should be a Director who can advance our businesses and undertake corporate activities to support sustainable economic development from a global perspective.

- ・The Representative, Executive President and COO should also participate in the working group.

- ・The members should represent a wide variety of departments including the Branding Strategy Dept., Group Strategic Management Dept., Corporate Planning Dept., Strategic Human Resources Dept., Sustainability Dept. and Global Business Division.

- ・The members should have a sense of gender equality

- ・The Committee should also include outside directors to hear opinions from objective and neutral perspectives.

- ・Third-party organizations should also be involved in committee activities to obtain advice and recommendations in the area of their expertise.

Strategy

We predicted changes in the external environment and analyzed the impact of climate change on our operations in the future, in accordance with the TCFD framework and using a scenario analysis method.

It is important for us to pursue sustainable growth by mitigating climate change and adapting to it through our business activities. Based on this understanding, we believe that actions to address climate change are important in the management of our business. We identify and assess its impact on us by forecasting changes in the external environment and our operating environment accompanying the manifestation of climate-related risks and by identifying risk events. In the scenario analysis, we referenced multiple existing scenarios published by organizations such as the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC).

・Specifying the businesses to be analyzed

- Scenario analysis is performed on a consolidated basis.

・Specifying risk items and opportunity items

- The TCFD recommendations divide the risks of climate into two categories, transition risks and physical risks. Based on these classifications, we examined risk items to identify the major risk items and opportunity items that are closely related to our businesses.

・Process of assessment and management

- The Climate Change Strategy WG takes the lead in the examination of risks, assessing their impact and discussing measures. The Sustainability Promotion Committee monitors policies for the handling of risks and the seizing of opportunities and the formulation of strategies and related efforts, and the Board of Directors supervises and receives reports from the Sustainability Promotion Committee as necessary. (The Sustainability Promotion Committee and the Climate Change Strategy WG meet every month)

- *The Climate Change Strategy WG includes Group Strategic Management Dept., Corporate Planning Dept., Treasury & Accounting Dept., General Affairs Dept., Sustainability Dept., and consolidated Group companies

・Definition of timeline (short, medium and long term)

- A characteristic of climate change is that it usually takes a longer time for its impact to manifest. We take this into consideration along with the target years specified by the Paris Agreement and the Japanese government to define the short-, medium- and long-term timelines as follows.

- *Short-term (Present - 2026)/medium-term (2030) / long-term (2050)

・Scenarios that were used

- 1.5℃ scenario:

A scenario in which the rise in the average temperature in the period up to the end of the 21st century will be held to 1.5 ℃ or less. Bold policies and technological innovations will be implemented to achieve sustainable development, and accordingly, it is highly likely that the social change resulting from the transition to a decarbonized society will affect our businesses. - 4℃ scenario:

A scenario in which the average temperature will rise by around 4 ℃ by the end of the 21st century. Almost no measures will be taken to address climate change, which means that there will be no social changes, but it is highly likely that abnormal weather and disasters that are a result of climate change will affect our businesses.

・Definition of degree of importance (large, medium and small)

- In assessing the impact of climate change on our financial affairs, we referenced the relevant matters of the timely disclosure standards of the financial instruments exchange concerning the correction of performance forecasts to classify the matters impacting net operating income and business profit. Matters that increase or decrease the net revenue forecast 10% or increase or decrease the business profit forecast 30% were classified as having a large impact as the scenario analysis would be performed on a consolidated basis.

| Classification of impact | Ratio to net revenue | Amount | Ratio to business profit | Amount |

|---|---|---|---|---|

| Large | 10% or more | 36.1 billion yen or more | 30% or more | 21.5 billion yen or more |

| Medium | 5% or more and less than 10% | 18.0 billion to 36.0 billion yen | 15% or more and less than 30% | 10.7 billion to 21.4 billion yen |

| Small | Less than 5% | 17.9 billion yen or less | Less than 15% | 10.6 billion yen or less |

*Calculated based on Group's consolidated business results in fiscal year 2023

<Business impact of risks>

| Types of risks and opportunities | Risks and opportunities | Business impacts | Indicators of impact on business operations | Financial impact | Extent of impact | Time span | |

|---|---|---|---|---|---|---|---|

| Risks | Transition risks | Policies and legal restrictions | Increased anti-global warming taxes, etc. | Impact on SG&A expenses | Approx. 0.35 billion yen | Small | Short term to long term |

| Introduction of a carbon tax leading to the prices of building materials soaring and the increase of real estate acquisition prices | Impact on revenue and assets | Approx. 1.65 billion yen | Small | Short term to long term | |||

| Adaptation to the building energy conservation act and ZEB | Impact on revenue and assets | Approx. 4.46 billion yen | Small | Short term to long term | |||

| Market | Rising energy prices | Impact on SG&A expenses | Approx. 0.22 billion yen | Small | Short term to long term | ||

| Decreasing demand for products and services due to changes in consumer behavior | Impact on revenue and assets | Approx. 0.52 billion yen | Small | Medium term to long term | |||

| Physical risks | Acute physical risks | Damage to buildings due to severer storms and floods | Impact on the head office, sales divisions and data centers, etc. | Approx. 0.23 billion yen | Small | Short term to long term | |

| Chronic physical risks | Worsening of the macro economy due to the impact of rising temperatures on agriculture, water resources, health, etc. | Impact on bad debt costs | Approx. 4.14 billion yen | Small | Short term to long term | ||

| Frequent occurrence of heatstroke due to a rise in the average temperature and an increase in electric power costs due to the use of air-conditioners | Impact on SG&A expenses | Approx. 0.22 billion yen | Small | Short term to long term | |||

<Measures to address business impacts>

| Types of risks and opportunities | Risks and opportunities | Business impacts | Countermeasures | |

|---|---|---|---|---|

| Risks | Transition risks | Policies and legal restrictions | Increased anti-global warming taxes, etc. | - Continuing to introduce renewable energy and energy-efficient equipment to reduce greenhouse gas emissions |

| Introduction of a carbon tax leading to the prices of building materials soaring and the increase of real estate acquisition prices | - Cooperating with suppliers to hold down the cost of construction, including the cost of raw materials | |||

| Adaptation to the building energy conservation act and ZEB | ||||

| Market | Rising energy prices | - Continuing to introduce renewable energy and energy-efficient equipment | ||

| Decreasing demand for products and services due to changes in consumer behavior | - Dealing in more ZEB and ZEH properties - Promoting investments aimed at decarbonization, including the development of environmentally certified properties |

|||

| Physical risks | Acute physical risks | Damage to buildings due to severer storms and floods | - Checking and examining hazard maps regularly to implement countermeasures, such as the revision of BCPs on an ongoing basis | |

| Chronic physical risks | Worsening of the macro economy due to the impact of rising temperatures on agriculture, water resources, health, etc. | - Continuing to evaluate the impact of the cost of bad debt by anticipating risks - Taking measures such as strengthening risk management and increasing provisions appropriately |

||

| Frequent occurrence of heatstroke due to a rise in the average temperature and an increase in electric power costs due to the use of air-conditioners | - Reducing power consumption through measures such as ensuring the high performance of newly constructed buildings and replacing equipment in the existing facilities we operate - Reducing power consumption by introducing flexible work hours and working systems |

|||

<Business impact of opportunities>

| Types of risks and opportunities | Risks and opportunities | Business impacts | Indicators of impact on business operations | Financial impact | Extent of impact | Time span | |

|---|---|---|---|---|---|---|---|

| Opportunities | Energy sources | Zero GHG emissions | Exemption from a carbon tax through the achievement of zero GHG emissions | Impact on SG&A expenses | Approx. 0.35 billion yen | Small | Short term to long term |

| Products and services | Eco-friendly products and services | Increase of revenue from eco-friendly products and services | Impact on revenue and assets | Approx. 0.52 billion yen | Small | Medium term to long term | |

| Impact of an increase of sustainability-oriented Customers on our sales indicators | In pursuit of Japan’s 2050 carbon neutrality target and the achievement of a decarbonized society through co-creation with enterprises and individuals, we have partnered with DATAFLUCT Co., Ltd. and started issuing SaisonCard for becoz, a credit card with a carbon neutrality perspective, the first of its kind in Japan, in June 2022. This credit card not only makes it possible for its users to visualize CO2 emissions based on the history of the daily use of the card but also makes it possible to offset CO2 emissions by purchasing carbon credits, thus helping increase its users' awareness of environmental issues. The issuing of the credit card and the promotion of its use encourage the sustainability-conscious younger generations of people to change their behavior to contribute to the decarbonization of society. It is expected that this use of credit cards will increase the reduction of CO2 emissions and contribute to our revenue in a long term. Profit has not yet been assessed because the method for calculating its impact on business is under review. |

- | Short term to long term | ||||

| Market | Impact of the expansion of circular economy on our sales indicators | It is expected that the progress in the transition of society as a whole to a circular economy will increase the number of opportunities that are presented in the recycling business through ReSAISON Co., Ltd., an equity-method affiliate. ReSAISON Co., Ltd. recirculates and recycles our assets whose leases have ended, with a focus on OA equipment. This is done by collecting and reselling them and through material recycling. The company has established a new secondary distribution market by carefully assessing the residual value of goods and circulating them with high efficiency. The expansion of the market is expected to lead to the expansion of the scale of this business through the increase in the number of clients, the expansion of product range, and the expansion of bases. Profit has not yet been assessed because the method for calculating its impact on business is under review. |

- | Short term to long term | |||

| Impact of the growing need for eco-friendly products on our sales indicators | Due to the growing need for eco-friendly products such as EVs, storage batteries, and solar power generation systems, it is expected that our entering the eco-friendly products for lease market will increase the number of business opportunities we have. It is also expected that opportunities will increase, including opportunities to replace current products with more energy-efficient ones. Profit has not yet been assessed because the method for calculating its impact on business is under review. | - | Medium term to long term | ||||

| Use of sustainability linked loans | Use of sustainability linked loans (SSLs) is expected to increase. SSLs offer preferential interest rates in financing and other incentives for the achievement of sustainability performance targets (SPTs) to solve environmental problems and social issues. It is anticipated that the SSL market will continue to expand. It is expected this will facilitate the reduction of financing costs, which is beneficial. Profit has not yet been assessed because the method for calculating its impact on business is under review. | - | Medium term to long term | ||||

<Measures to address business impacts>

| Risks & Opportunities | Risks and opportunities | Impact on business | Countermeasures | |

|---|---|---|---|---|

| Opportunities | Energy sources | Zero GHG emissions | Exemption from a carbon tax through the achievement of zero GHG emissions | - Continuing to introduce renewable energy and energy-efficient equipment to reduce greenhouse gas emissions |

| Products and services | Eco-friendly products and services | Increase of revenue from eco-friendly products | - Dealing in more ZEB and ZEH properties - Promoting investments aimed at decarbonization, including the development of environmentally certified properties |

|

| Impact of an increase of sustainability-oriented customers on our sales indicators | - Promoting the issuance of cards and stimulating the use of cards by enhancing and expanding the cards' functions which result in the offsetting of carbon emissions and the protection of the environment | |||

| Market | Impact of the expansion of circular economy on our sales indicators | - Expanding the scale of the ReSAISON Co., Ltd business by increasing the number of clients it has (to include companies other than Credit Saison), the number of products it deals in (to include products other than multifunction printer and PCs, which are its mainstay products), and the number of branches (which is currently four) | ||

| Impact of the growing need for eco-friendly products on our sales indicators | - Considering and introducing eco-friendly properties for lease - Promoting the replacement of existing equipment for lease with energy-efficient products, such as the acceleration of the switch from fluorescent to LED lights to prepare for the ban on the production, import and export of fluorescent lights that will come into force at the end of 2027. |

|||

| Use of sustainability linked loans | - Striving to achieve ambitious sustainability performance targets (SPTs) to receive preferential interest rates | |||

*Calculated to a limited extent based on the FY2023 consolidated results

・Climate transition plan for achieving net zero carbon emissions by 2025

Risk management

The Risk Management Committee and Corporate Risk Management Dept. lead the efforts to prevent risks and minimize the impact of risks should they occur. In addition, the Audit Dept. regularly and independently examines the status of the Corporate Risk Management Dept.'s monitoring of departments. These and other efforts are implemented to reinforce the system. To this end, our employees regularly receive in-house training and endeavor to maintain our risk management system in accordance with the Risk Management Regulations, Regulations on Management of Risks of Losses and Crisis Management Regulations. In addition, the Corporate Risk Management Dept. and the Audit Dept. hold information-sharing sessions every month to strengthen their cooperation. Regarding the issues underlying the Credit Saison Group or governance-related matters accompanied by serious risks, the Group Strategic Management Department leads the supervision of the companies of the Credit Saison Group's execution of business and shares information with the supervisory divisions of the Credit Saison Group companies.

For climate change risks, the Sustainability Promotion Committee leads the formulation of policies and strategies for minimizing risks and seizing opportunities and structurally monitors related efforts.

The Sustainability Dept., which is the executive office of the Sustainability Promotion Committee, will play a key role in the regular review of risks and opportunities while also collaborating with Audit Dept., Corporate Risk Management Dept., Corporate Planning Dept., Treasury & Accounting Dept. and General Affairs Dept.

Metrics and targets

The consolidated companies of the Credit Saison Group are within the scope of measurement.

The impact of the seven companies that are collectively responsible for more than 95% of net revenue is measured.

Reduction of greenhouse gas emissions: targets and progress

Our 2030 greenhouse gas emissions reduction targets were certified by the Science Based Targets initiative (SBTi) as being consistent with levels required to meet the 1.5 ℃ target outlined in the Paris Agreement.

<Greenhouse gas emissions targets (FY2030)>

・Reduction of Scope 1 and 2 greenhouse gas emissions by 44% (base year: FY2020)

・Reduction of Scope 3 greenhouse gas emissions by 25% (base year: FY2020)

We will continue our efforts to reduce greenhouse gas emissions from our business activities, with a view that the transition to a decarbonized society as a business opportunity, and strive to achieve both the growth of our businesses and the reduction of our environmental footprint.

| Unit: Tons CO2 | |||||||||||

| Result | Target | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 | FY2028 | FY2030 | ||||

| Scope1 | Direct greenhouse gas emissions from the business operator itself | 1,023 | 388 | 342 | 643 | 822 | Compared to FY2020 22% reduction | Compared to FY2020 35% reduction |

Compared to FY2020 44% reduction | ||

| Scope 2 (market standard) | Indirect greenhouse gas emissions from the use of electricity, heat, and steam, which are supplied from other companies | 17,540 | 17,847 | 17,908 | 11,976 | 7,924 | |||||

| Scope 2 (location standard) | 17,856 | 17,947 | 17,712 | 14,116 | 13,433 | ||||||

| Scope 1 + Scope 2 (market standard) subtotal | 18,563 | 18,235 | 18,250 | 12,619 | 8,746 | 14,521 | 12,096 | 10,479 | |||

| Scope 1 + Scope 2 (location standard) subtotal | 18,879 | 18,334 | 18,054 | 14,758 | 14,256 | 14,763 | 12,243 | 10,663 | |||

| Category 1 | Purchased products and services | 81,712 | 65,355 | 85,128 | 98,567 | 123,106 | Compared to FY2020 12.5% reduction | Compared to FY2020 20% reduction | Compared to FY2020 25% reduction | ||

| Category 2 | Capital goods | 323,542 | 332,878 | 403,120 | 456,894 | 518,685 | |||||

| Category 3 | Fuel and energy-related activities that do not fall under Scopes 1 and 2 | 3,071 | 2,999 | 2,963 | 2,485 | 2,422 | |||||

| Category 4 | Transportation and distribution (upstream) | - | - | - | - | - | |||||

| Category 5 | Waste generated by operations | 132 | 277 | 380 | 318 | 251 | |||||

| Category 6 | Business travel | 781 | 1,133 | 1,533 | 1,385 | 1,960 | |||||

| Category 7 | Employee commute | 1,587 | 2,295 | 2,537 | 2,830 | 2,510 | |||||

| Category 8 | Leased assets (upstream) | - | - | 6 | 1,777 | 208 | |||||

| Category 9 | Transportation and distribution (downstream) | - | - | - | - | - | |||||

| Category 10 | Fabrication of sold products | - | - | - | - | - | |||||

| Category 11 | Use of sold products | 47,510 | 60,347 | 63,392 | 38,347 | 49,241 | |||||

| Category 12 | End-of-life treatment of sold products | 2,779 | 2,573 | 2,808 | 1,731 | 2,289 | |||||

| Category 13 | Leased assets (downstream) | 262,955 | 251,332 | 252,721 | 247,719 | 94,248 | |||||

| Category 14 | Franchises | - | - | - | - | - | |||||

| Category 15 | Investment | - | - | - | - | - | |||||

| Scope3 | Indirect greenhouse gas emissions, which does not fall under Scopes 1 and 2 (emission from other companies associated with the activities of the reporting company) | 724,069 | 719,188 | 814,588 | 852,053 | 794,919 | 633,560 | 579,255 | 543,052 | ||

| Scope 1,2,3 Total (supply chain emissions) | 742,632 | 737,423 | 832,838 | 864,672 | 803,665 | 648,081 | 591,351 | 553,531 | |||

*C4: Relevant activities have been included in other categories

*C8: Relevant activities in Japan have been included in Scopes 1 and 2

*C9,10,14: No relevant activity

*C15: We will consider calculating it in the future

*The target for FY2030 is based on SBTi (Science Based Targets initiative) certification.

*The calculation values for the transitional years have been partially recalculated due to the acquisition of SBTi accreditation.

*We calculate the total emissions of all GHGs, but our group only counts the CO2 emissions generated and excluding the other insignificant emissions.

*We have collaborated with WasteBox, Inc. for The initiatives based on the calculation of Scopes 1, 2 and 3 emissions and the TCFD disclosure framework.

*From FY2022, the measurement results of 7 companies are disclosed, including Kisetsu Saison Finance (India) Pvt.Ltd.

*From FY 2024, we have revised the calculation logic for Scope 3 Category 13 and thereby we have implemented more realistic and precise calculations.

Third-party assurance on environmental data

To ensure the reliability of our environmental data, we have obtained an independent third-party assurance from LRQA Limited.

Independent Assurance Statement