- Financial Capital Policy|Message from the Managing Executive Officer in charge

- Global Business|Message from the Director in Charge

- Finance Business|Message from the Director in Charge

- [Special Feature] Saison Smart Real Estate Investment: Interview with managers

- Status of Initiatives with Suruga Bank

- Payment Business|Message from the Director in Charge

Payment BusinessMessage from the Director in Charge

Building a robust revenue

base through the premium

strategy and DX

Director, Managing Executive Officer

Company-wide Corporate Sales strategy

Head of Branding Strategy Dept.,

SaisonAMEX Division,

General Manager, SaisonAMEX Division

Shunji Ashikaga

In FY2024, the Payment Business achieved major successes in terms of both profitability and growth potential as a result of efforts aimed at accelerating the premium strategy and driving structural reforms. With rising prices, growing wages, and other changes in the macro environment acting as a tailwind, a forward-looking stance on consumption and investment spread throughout the economy. Against this backdrop, we expanded our lineup of premium cards and revised our revolving fee rate, which ultimately led to record high levels of profit on an individual segment basis. In October 2024, we launched the “post-purchase revolving payments” service in part to help capture new customer segments. Similarly, we achieved steady progress in building a sustainable revenue base by applying DX and AI to streamline operations, and by revising the cost structure.

In FY2025, we will introduce a service fee for inactive card users to strengthen our reach over customer segments with a strong intention to use their cards. We will also seek to enhance the customer experience in terms of both digital and emotional value, by strengthening our comprehensive partnership with the Mitsui Fudosan Group, including affiliated cards with Mitsui retail facilities, providing discount movie tickets for TOHO Cinemas, issuing the “DMM JCB Card” in cooperation with DMM, and collaborating with Hoshino Resorts.

Centered on expansion of the non-asset area, the Payment Business growth strategy will accelerate our entry into loan factoring services for SMEs in collaboration with Suruga Bank, as well as the insurance and securities fields, with the aim of sustainably raising corporate value.

Medium-term Management

Plan: Priority Theme

Accelerating the premium strategy and reducing costs through structural reforms

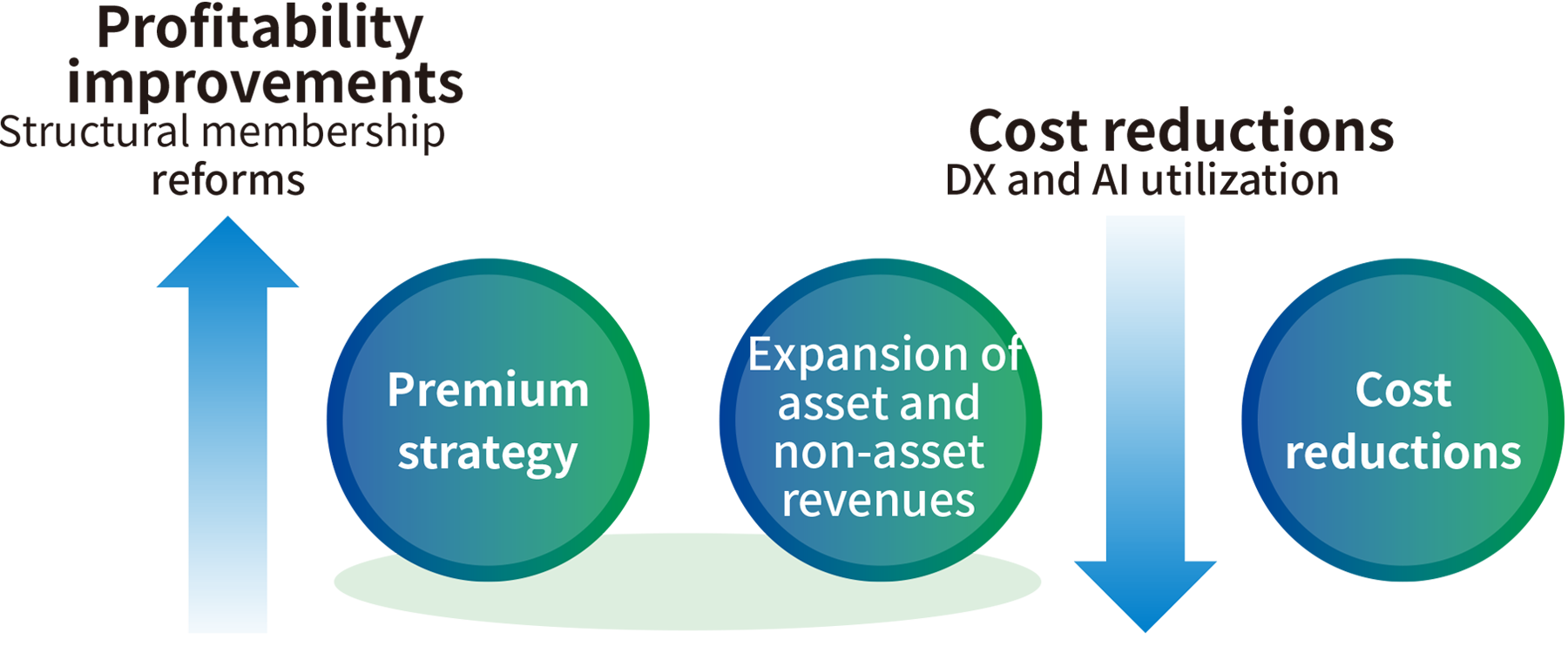

As part of our efforts to improve profitability in the Payment Business, we are promoting a “premium strategy” that aims to reform the membership structure and improve loyalty by promoting premium cards and providing added value, as well as “expanding asset and non-asset revenue” in an effort to improve the revenue ratio by designing a fee structure commensurate with services in line with revisions to market appeal, a review of revolving rates, and other measures. In the area of cost reduction, we will work to expand profits by implementing “cost structure reform” through a review of operations utilizing DX and AI, as well as reallocating personnel to growth businesses and reducing temporary employment.

Please refer to financial results briefing materials for progress updates on the latest initiatives.

Providing Value Derived from the Saison Partner Economic Zone

Leveraging its existing strengths as an independent non-bank, Credit Saison has issued affiliated cards with partners in different industries and provided original services. In March 2025, we launched an exclusive new service for members of cards issued by Credit Saison called “Saison Thursdays,” which allows cardholders to watch a movie of their choice at TOHO Cinemas throughout Japan every Thursday for ¥1,200 (tax included). We will continue to consider additional benefits for all Saison card members, and plan to leverage the “Saison Partner Economic Zone” to provide services that pursue emotional value above functional value while staying true to Credit Saison.

Providing services that embody Saison’s uniqueness

As a new service that allows our customers to enjoy movies for ¥1,200, “Saison Thursdays” has been well received by our members, thereby providing a smooth start as a new service that prioritizes emotional value. This service offers a rich experience through movie viewing, thereby allowing our members to experience something of special value. Going forward, we will further strengthen our alliances with partner companies and increasingly broaden the unique content and experience value of Saison with the aim of enhancing brand value.

Yuki Takashita

Alliance Sales Dept.

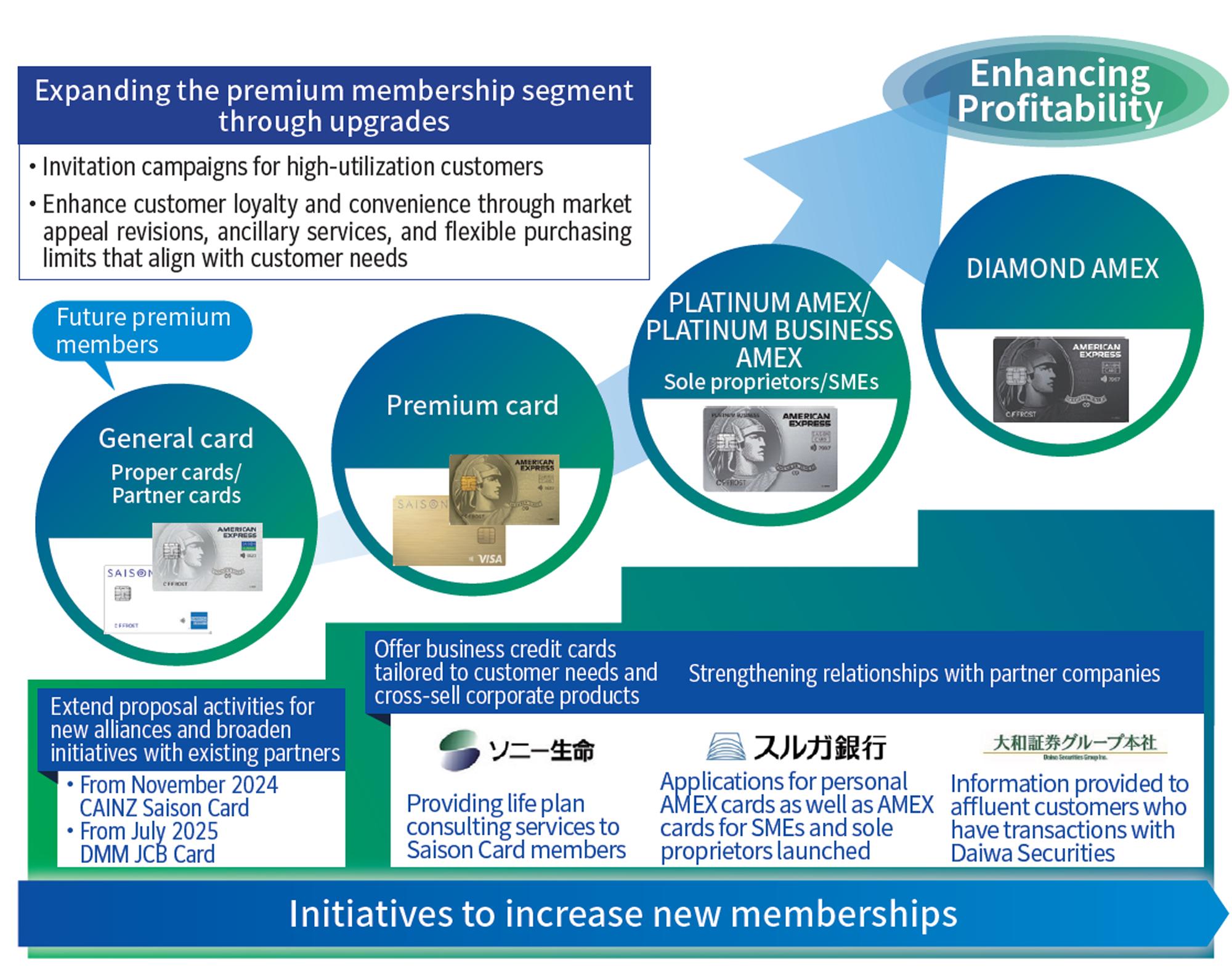

Enhancing Profitability through the Premium Strategy

Along with GOLD cards and other more-exclusive paid cards for individuals, the premium strategy defines cards for sole proprietors and SMEs as “Premium Cards,” for which we aim to expand membership. Compared to other cards, these tend to achieve higher profitability because premium card members use them more often and make high-unit-price purchases. Although premium card members only accounted for approximately 20% of all active credit card members as of the end of FY2024, they made up around 45% of profit and contributed to higher profit margins.

Initiatives for Expanding Profit and Building a Membership Base

Leveraging its alliances with various partners, Credit Saison is working to expand the membership base and update card benefits and services in an effort to advance profit expansion and customer return initiatives.

Releasing the DMM JCB Card

In July 2025, we released the “DMM JCB Card” as part of a new partnership strategy that targets use of digital services. This card is designed for DMM users, who tend to be from younger customer segments, and offers a high return rate of 3% in the form of DMM points (1% for non-DMM services). Available in 13 card designs, including collaboration designs with popular products from DMM GAMES, it also offers a variety of services centered on the card.

Revising the market appeal for profitability improvements

Credit Saison is working to revise and expand card benefits in line with customer needs, and to design fee structures that are commensurate with its services. In June 2025, we revised annual membership fees for the Saison Platinum American Express® Card and Saison Platinum Business American Express® Card. This revision was in line with efforts to enhance services, which included raising the Eikyufumetsu Points ratio and introducing an additional digital concierge service and new insurance coverage.

Initiatives for expanding asset revenue

In light of changes in the financial environment, we raised the Saison brand revolving fee rate up to 18% starting with withdrawals in November 2024. Making this move as we sought to acquire the understanding of our credit card members mitigated the impacts of customer attrition more than expected, thereby enabling us to present an outlook for profit growth of approximately ¥9.0 billion per year.

* “American Express” is a registered trademark of American Express. Credit Saison Co., Ltd., uses the trademark under license from American Express.

Structural Reforms Leveraging DX and AI

We aim to improve profit margins by downsizing and eliminating unprofitable operations and streamlining operations through the use of DX and AI. Our structural reforms have reduced the headcount from approximately 4,000 as of April 2023 to approximately 3,300 as of March 31, 2025 (a 17.5% decline over two years) and have reallocated personnel to growth businesses.

Effects generated by structural reforms

Through a cycle of “consolidation, decluttering, DX, and improvements,” our structural reforms have steadily produced outcomes and successfully reduced 25,500 hours’ worth of work over the two-year period from April 2023 to March 2025. As part of this effort, we employed in-house development using low-code tools to streamline manual work, including settlement operations, as well as personalized work, and have sought to create an environment in which employees can focus on value-creation activities. I was particularly impressed by how this effort enabled fast-paced responses and flexible improvements through development within business divisions, and by how we have experienced the outcomes of operational improvements on the front lines.

Sakura Kato

Strategic Planning Dept.

Structural Reform DX Group