- Financial Capital Policy|Message from the Managing Executive Officer in charge

- Global Business|Message from the Director in Charge

- Finance Business|Message from the Director in Charge

- [Special Feature] Saison Smart Real Estate Investment: Interview with managers

- Status of Initiatives with Suruga Bank

- Payment Business|Message from the Director in Charge

Finance BusinessMessage from the Director in Charge

Eyeing the creation and

provision of new value

Director, Managing Executive Officer

Head of Finance Division,

General Manager, Finance Division

Naoki Nakayama

Over the past 10 years, Credit Saison and Saison Fundex Corporation have steadily expanded, developing the Finance Business into a core pillar of operations. Profit in the Finance Business reached ¥38.6 billion in FY2024, roughly three times the level of FY2014. Core offerings include credit guarantees, real estate finance, and Flat 35 housing loans. In the Guarantee Business, we have continued to provide non-secured loan guarantees for domestic financial institutions and mortgage guarantees since FY2022. In the Real Estate Finance Business, we offer asset formation loans to meet individual real estate investment needs, secured loans for real estate businesses, non-recourse loans for SPCs, and equity investments in private REITs. Through this wide-ranging Finance Business, we are steadily building up loan and investment balances while expanding earnings.

We are never satisfied with the status quo and continue to provide new finance products that meet changing market and customer needs. As Japan enters an era of 100-year life spans and individual needs for asset formation shift from savings to investment, we must create new growth business models that leverage our cardholder base established in the Payment Business. One answer to this is our May 2025 launch of Saison Smart Real Estate Investment, Japan’s first real estate security token created by a credit card company. This new business domain maximizes our expertise and track record in the Finance Business, combining our strengths in the member base of the Payment Business, real estate finance know-how, and technology. In doing so, we launched a new service that offers an easy, stable investment product that can be started with small amounts. Saison Smart Real Estate Investment is not a limited-time product, but one we plan to continue offering as a series.

We believe that the role of the Finance Business is to act as a forerunner in responding to constantly diversifying market needs. We will continue to leverage our strength of creating and delivering new values to fulfill this role.

In April 2025, we launched Saison Smart Real Estate Investment as Japan’s first* real estate security token issued by a credit card company. Traditionally, real estate investment required substantial up-front capital to purchase properties and was generally considered suitable only for people with ample wealth. By digitizing and fractionalizing real estate into securities, Saison Smart Real Estate Investment provides new investment opportunities that can be started with small amounts of money, supporting asset formation for a wider range of customers.

* As of the April 2025 press release; based on our research, as a publicly offered product.

Special FeatureSaison Smart Real Estate Investment Interview with managers

From left

- Finance Planning Dept.,

Finance Division - Yoshiyuki Ishii

- Structured Finance Dept.,

Finance Division - Yui Hidaka

From left

- Finance Planning Dept.,

Finance Division - Yoshiyuki Ishii

- Structured Finance Dept.,

Finance Division - Yui Hidaka

Please tell us the back story that led to the creation of Saison Smart Real Estate Investment.

- Ishii

- Among younger generations in particular, concern about relying solely on the national pension system for retirement has heightened awareness of the need to take responsibility for asset formation from an early age. We have provided our cardholders with opportunities for asset formation through programs such as point investment and credit card installment savings. We wanted to take these initiatives a step further by designing and developing our own investment products, thereby providing more direct support for asset formation.

- Hidaka

- With the launch of the new Nippon Individual Savings Account (NISA) system, individuals are becoming more interested in investing. We also wanted to leverage our real estate-related assets to give our cardholders more accessible investment opportunities, and that desire informed the development of this product.

What impact do you aim to have by entering the real estate security token (ST) business?

- Ishii

- By offering both payment (card settlement) and finance (asset formation and investment) to our cardholders, we can be more involved in customers’ lifestyles and connect more deeply with them. In turn, this should enhance customer loyalty and enable us to build long-term relationships.

- Hidaka

- Up to now, our limited “points” of contact with cardholders have been mainly through credit card payments and lending. However, with the features of this ST product and the self-offering method of selling directly to customers without going through a securities company, we believe we can build broader, “multidimensional” relationships with customers.

We aim to go beyond meeting traditional payment and daily finance needs to cultivate relationships that address deeper interests, such as investment orientation and asset formation.

This is the first ST product offered by a credit card company. What are its main features?

- Ishii

- One feature is that investment product purchases can be paid for using Eikyufumetsu Points, namely points that never expire. This allows cardholders to use points accumulated through daily card use for asset formation. As investments can also be started with a small amount of cash, we believe this will encourage more cardholders to begin real estate investing with ease.

- Hidaka

- We have adopted a senior-subordinated structure. In particular, the fact that we assume the subordinated portion is, to put it in other words, a statement that this is a product worth investing in ourselves. It shows our stan ce of not simply selling and being done with it, but of sharing risk with investors and growing value together.

How have cardholders responded, and what have the actual sales been like?

- Ishii

- More than 2,000 investors applied, and about half of them used Eikyufumetsu Points for their purchases. Despite the offering being limited to cardholders, the results exceeded our expectations. We believe the low entry barrier of being able to start from small amounts, combined with the ability to use Eikyufumetsu Points, lowered hurdles to investing and made the product attractive to many members.

What are your future plans for development?

- Hidaka

- With the first offering, we focused on designing a product that a broad range of investors could hold with confidence. Going forward, while listening attentively to investor needs, we also aim to consider products with higher risks and returns, contributing to market development. By expanding the range of return options, we believe a market that meets diverse investor needs will be formed, and through real estate ST products we will strive to promote “the democratization of finance.”

Medium-term Management

Plan: Priority themeExpanding profits and enhancing competitiveness through Group business

As the Group’s largest growth driver, we will continue to secure stable revenue from existing products while also working to expand our business foundation by improving our off-balance sheet ratio with an emphasis on asset efficiency.

We aim to create products that meet market needs and build our customer base by leveraging our unique strengths, such as digital transformation (DX) and sales capabilities.

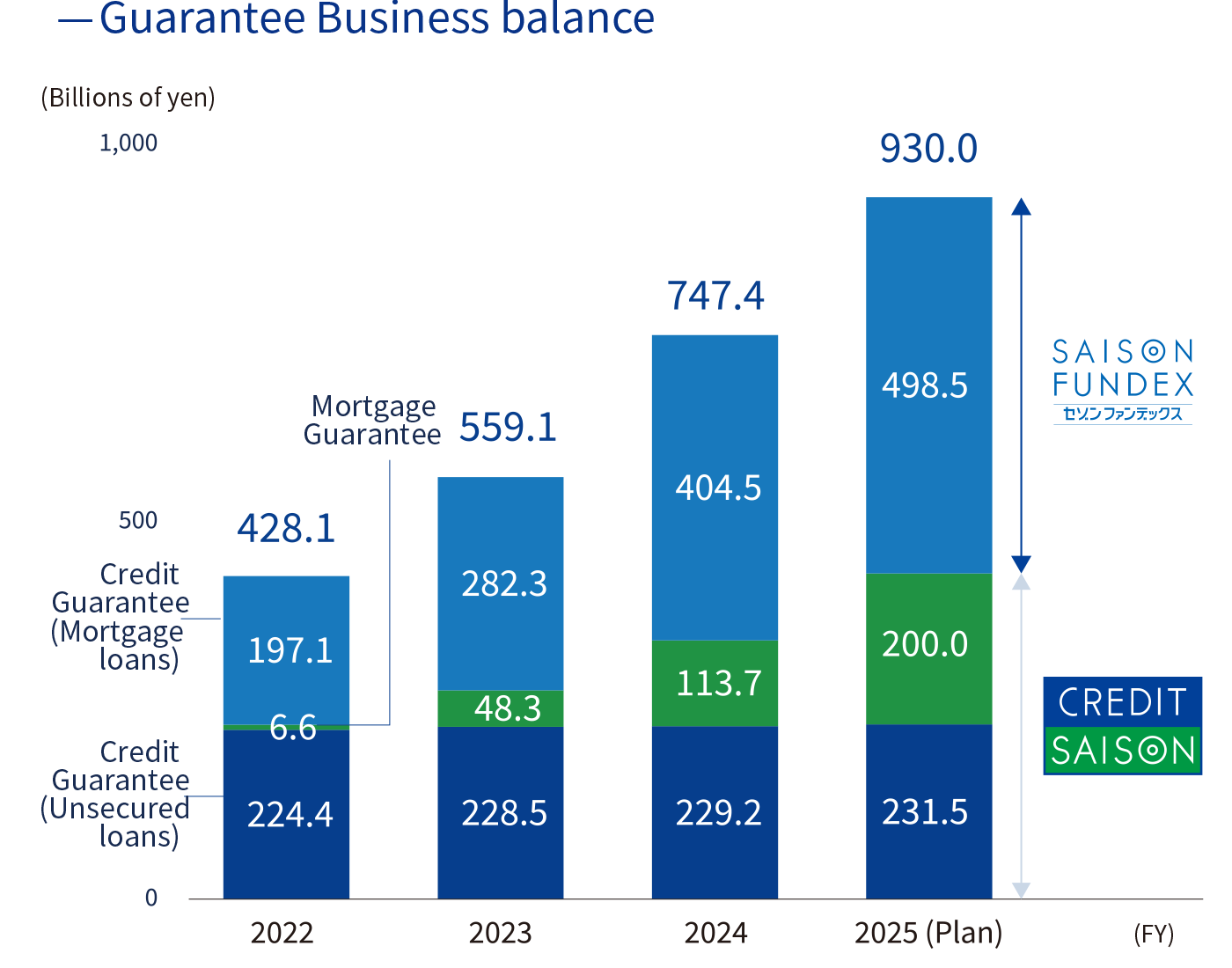

Guarantee Business

We provide guarantee services for loans offered by partner financial institutions.

Since launching our unsecured loan guarantee business in 1985, we have expanded our network of partner financial institutions to about 400. In April 2022, we entered the mortgage guarantee business, promoting cross-selling of unsecured loans, and since October 2023, we have expanded balances further through collaboration with Suruga Bank.

Saison Fundex has been expanding balances by providing long- term guarantees for a wide range of funding needs, including unsecured loans, business loans, and real estate purchases, secured by real estate. Through stronger collaboration with Credit Saison, the number of partner financial institutions reached 48 nationwide as of the end of March 2025.

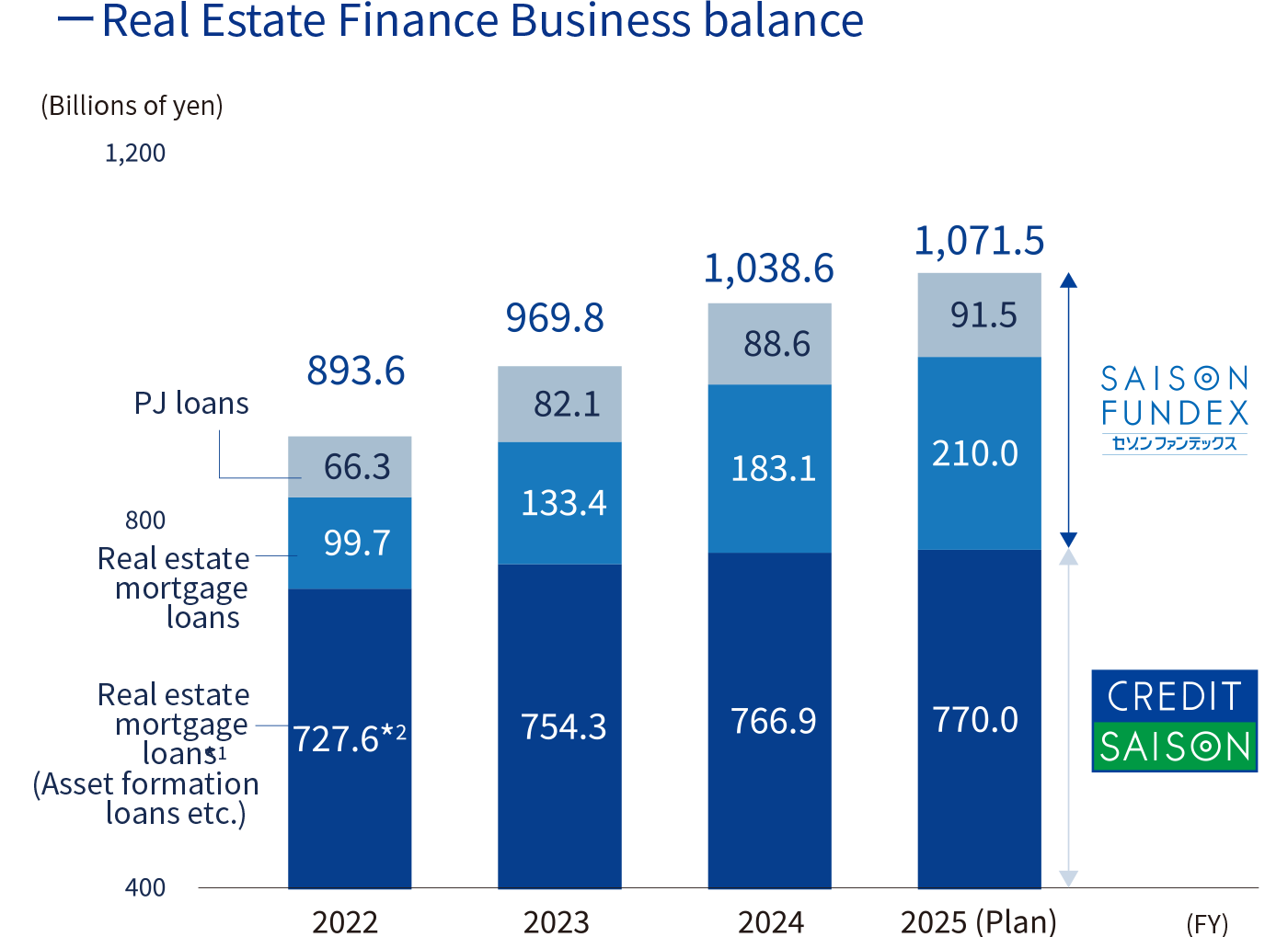

Real Estate Finance Business

Credit Saison is expanding services to meet the diverse needs of a wide range of customers, including individuals and real estate businesses.

For individuals, we added a short-term prime rate-linked product in August 2024 to our asset formation loans, which are loans to individuals for purchasing condominiums for investment purposes, in addition to our conventional long-term prime rate-linked products. While transaction volumes are increasing, repayments in a rising interest rate environment have kept balances flat.

In addition, balances for the collaboration loan we launched with Suruga Bank in November 2023 are steadily expanding. We will continue to promote this initiative with Suruga Bank by leveraging the expertise of both companies.

Saison Fundex leverages its strengths in screening speed and expertise to offer real estate-secured loans that address diverse funding needs, such as real estate investment and financing, as well as project financing that provides procurement funds to real estate businesses. By strengthening web promotions, enhancing relationships with existing clients, and expanding new partnerships, we aim to steadily expand balances.

*1 Figures for real estate-secured loans include not only asset formation loans but also loans to corporations and high-net-worth individuals.

*2 Asset formation loans Sales of receivables FY2021-FY2022 cumulative total ¥110.0 billion

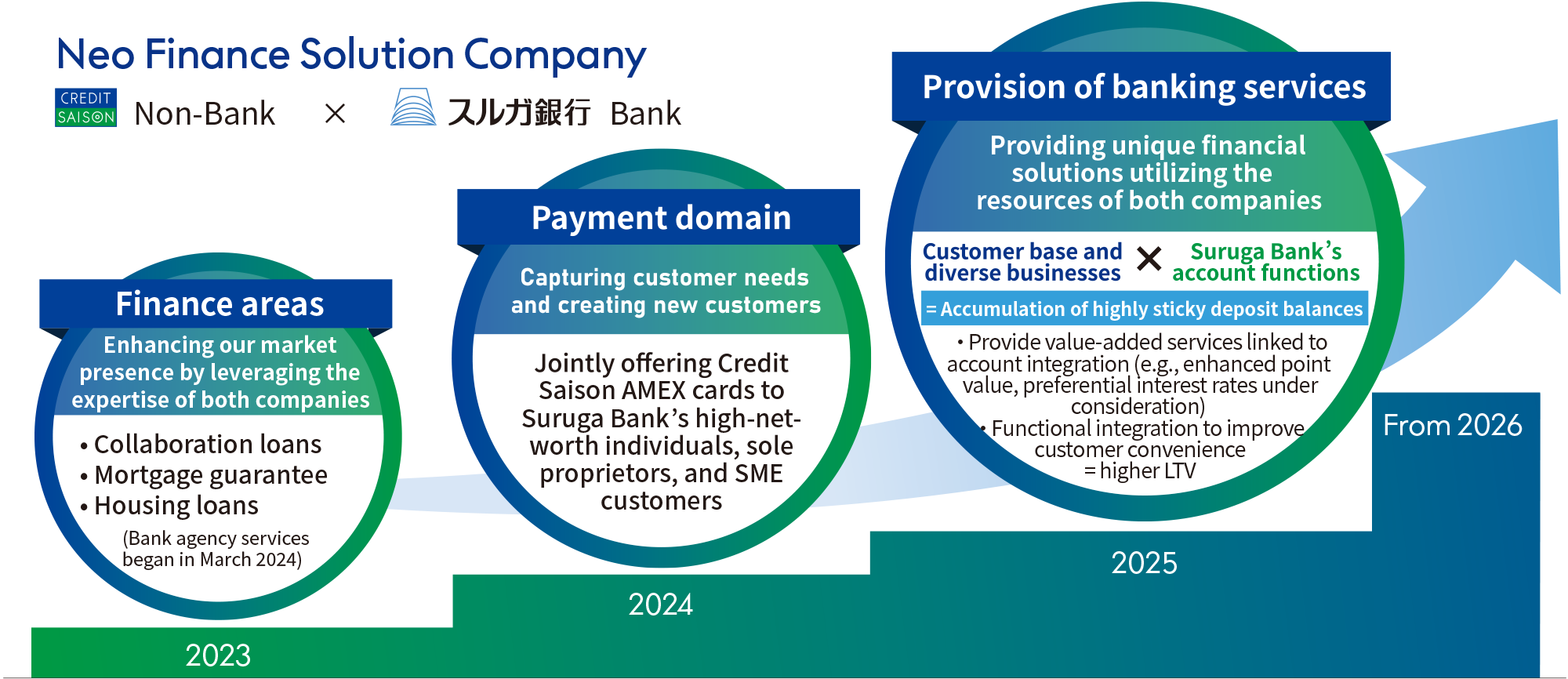

Status of Initiatives with Suruga Bank

The capital and business alliance with Suruga Bank, launched in FY2023, has been progressing well, centered on the finance and payment domains, through leveraging the know-how and human resources of both companies. From FY2025, we will further deepen our initiatives toward providing unique financial solutions, aiming to become a Neo Finance Solution Company that offers solutions to every customer challenge and uncertainty*1

*1 Anxiety, inconvenience, dissatisfaction

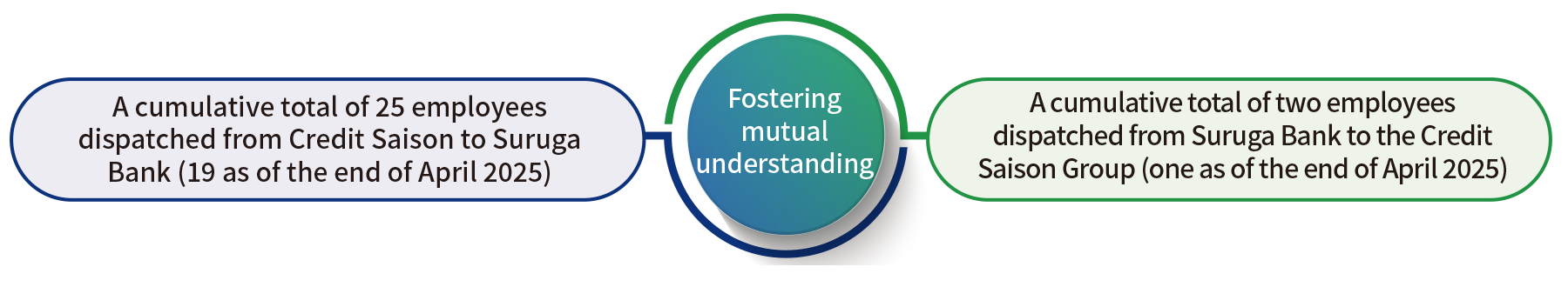

Credit Saison × Suruga Bank: Example of human resource exchange activities

The exchange of personnel between the two companies, which began in August 2023, has increased. As of the end of April 2025, 20 individuals were participating in the exchange program, with a cumulative total of 27 since its inception. This deepens mutual understanding of each company’s products and businesses, strengthening our sense of unity as a Group. To jointly utilize management resources, we will continue to accelerate personnel exchanges, invigorating our businesses and deepening collaboration.

Seconded from Credit Saison to Suruga Bank

After about a year of being dispatched to the Internet Branch to handle mortgage lending, I now belong to the Metropolitan Sales Department III, responsible for investment real estate loans. My role involves providing loans to investors as well as sales and marketing to real estate brokers and intermediaries. It is highly rewarding to be involved in major decisions, such as purchasing investment real estate, which form part of customers’ long-term life plans, and to contribute to their life design. For the lending products I oversaw in the past, I focused on making swift credit decisions, but in my current role, it is more important to view real estate investment as a business. I have come to realize the importance of taking the necessary time to conduct risk analysis on many levels.

At Suruga Bank, I feel there are similarities with Credit Saison in terms of customer-first service development, product creation, and a customer-centric approach. At the same time, the significant emphasis on compliance as a bank also stands out, with thorough initiatives and training in place. I also see this secondment as an opportunity to deepen my own knowledge and experience as a financial professional. By incorporating diverse perspectives, I will continue working to improve my skills while contributing to the growth of Suruga Bank.

Takuya Terada

Metropolitan Sales

Department III

Metropolitan & Wide-Area

Bank Division

Suruga Bank Ltd.