Risk Management and Compliance

Risk ManagementRisk Management

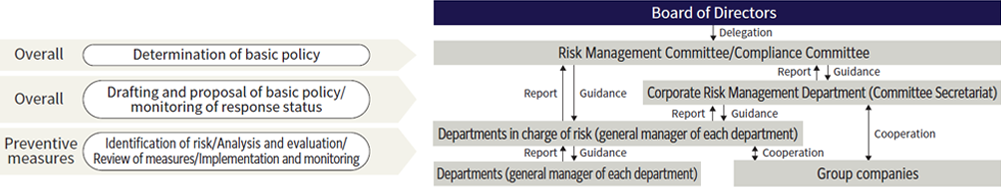

To ensure its sustainable growth as a “GLOBAL NEO FINANCE COMPANY – A global comprehensive life services group with finance as our core,” Credit Saison has established a framework to comprehensively identify and manage various risks faced by the Company as well as the Group. Under this framework, we strive to maintain a sound, resilient management foundation by classifying and assessing these risks in accordance with the characteristics of each business and changes in the external environment. This includes, for example, taking appropriate action. The Risk Management Committee identifies major risks through risk assessments as well as the appropriate response. The Committee also cooperates with each business division to confirm the progress and effectiveness of each risk response on a regular basis, and leverages Risk Capital Management (RCM), Asset-Liability Management (ALM), and other methods in an effort to build a financial base that is resilient to risk.

The Payment and Finance businesses seek to stabilize operations and achieve sustainable growth through a process that entails ensuring appropriate credit, risk management, and loan collection. As part of our credit management endeavors, we undertake a careful assessment of customer creditworthiness based on strict screening criteria, and strive to reduce bad debt risk. Once a transaction begins, we have established a system that identifies signs of risk at the earliest stages and takes the necessary action by confirming and analyzing both the credit and repayment status of customers on a regular basis. As far as our loan collection activities are concerned, we have established an efficient collection process to maintain the soundness of loans. Moreover, as a company that engages in business across the globe, we are working to strengthen our global governance structure in a bid to address changes in financial regulations in each country, foreign currency exchange risk, economic and political instability, and a number of other risks. This effort is being led by the International Headquarters (IHQ) of Saison International Pte. Ltd. In cooperation with local financial institutions, attorney offices, and others, we continuously monitor the latest regulatory trends and market environments, and strive to reduce risk based on their expertise.

Moreover, as an enterprise that is responsible for aspects of social infrastructure, we have formulated a BCP to ensure the continuity of critical operations whenever possible, even in the event of an earthquake, other natural disaster, or accident. Under our BCP, we have also established emergency systems and identified roles as well as response matters for the purpose of restoring operations at the earliest possible time. Furthermore, we prepared an internal reporting system in accordance with Japan’s Whistleblower Protection Act for the purpose of preventing and rapidly addressing legal violations and improper acts. Through these initiatives, we are working to strengthen the business foundation and build a stable earnings structure.

ComplianceCompliance

Credit Saison has positioned legal compliance, fairness, and ethical standards in its corporate activities as one of the Company’s most important priorities. Likewise, we established the “Declaration of Conduct” as a basic action guideline to clearly illustrate the stance upon which we must engage with society. In addition, we formulated our “Standards of Conduct” to define the specific actions that officers and employees must take, which enables us to appropriately execute business under a unified Group-wide approach.

To build a compliance system, we have established the Compliance Committee, which is chaired by the officer responsible for the Corporate Risk Management Department. The Compliance Committee reports on and verifies compliance promotion plans, training plans, and the status of compliance with each law, and implements improvements on an ongoing basis.

We have also assigned compliance officers and compliance staff to each department in an effort to instill an awareness toward compliance throughout the organization. At the same time, we have strengthened the framework for ensuring that business operations are consistently performed at a practical level. Moreover, we disclose information through the employee website and regularly hold compliance training programs as part of our efforts to organize an environment that ensures each employee thoroughly understands the latest rules and can make appropriate judgments. Through these initiatives, employees come to practice compliance of their own initiative, and we commit ourselves to instilling compliance on a Group-wide basis.

Preventing Bribery and Corruption

The Company prohibits bribery and improper benefits. We provide no entertainment or gifts to public civil servants or equivalents who are prohibited by law from receiving entertainment or gifts. We also prohibit giving or accepting excessive entertainment or gifts even in the case of business partners. We will continue to instill awareness among all employees through training programs that use the employee website with the goal of ensuring that our employees do not provide entertainment or gifts beyond the scope of social common sense.

Anti-money Laundering

Credit Saison has built a framework and operational system with respect to money laundering and terrorism financing measures under the active leadership of the management team. This system is based on the Guidelines for Anti-money Laundering and Combating the Financing of Terrorism published by Japan’s Financial Services Agency and Ministry of Economy, Trade and Industry.